Fermi, a Texas-based company that aims to power artificial intelligence (AI) data centers with natural gas and nuclear power, has priced its initial public offering (IPO) at the top end of expectations.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company is selling $682.5 million worth of shares at $21 each to investors in New York and London through a simultaneous dual listing on the Nasdaq Composite (NDAQ) and London Stock Exchange. Fermi’s stock will trade under the ticker symbol “FRMI.”

The IPO price gives Fermi a market valuation of $13.80 billion. The IPO and nearly $14 billion valuation come less than a year after the company was founded. Fermi was only founded 10 months ago, yet demand for its IPO appears strong, with the stock expected to rise 60% once it begins trading on Oct. 1.

Bull Run?

Founded in January, Fermi intends to build the largest data center campus in the world on a parcel of land in the Texas Panhandle that it’s leasing from Texas Tech University. The 5,236-acre site will eventually be home to data center warehouses hooked up to natural gas plants, nuclear reactors, solar panels, and batteries, according to Fermi’s management team.

The Texas data center site is expected to generate five times as much electricity as the Hoover Dam by 2038 once the project is fully operational. Analysts say Fermi is racing to market in an effort to capitalize on investor interest in all things related to AI. However, some analysts caution that Fermi has an ambitious plan but without much progress to date.

The company competes with both traditional electricity providers such as GE Vernova (GEV) and start-ups such as nuclear energy provider Oklo (OKLO), both of which plan to also power AI data centers.

Is OKLO Stock a Buy?

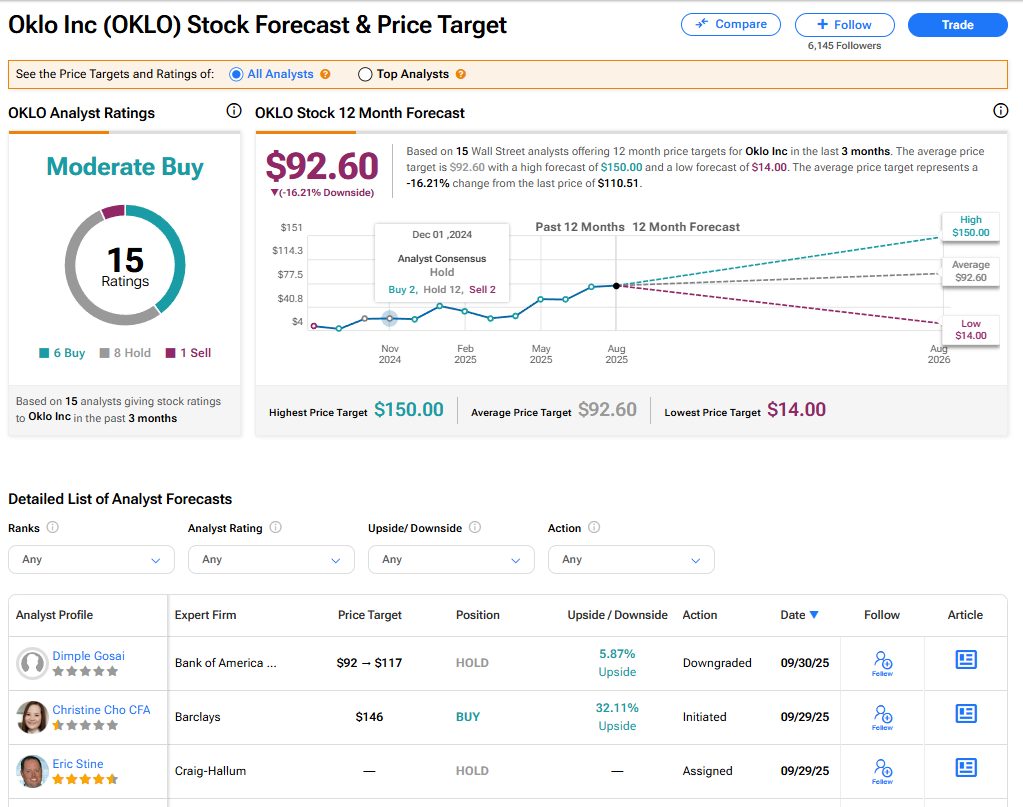

It’s too early for analysts to rate Fermi stock. So instead, we’ll look at the stock of rival Oklo. As one can see below, Oklo has a consensus Moderate Buy rating among 15 Wall Street analysts. That rating is based on six Buy, eight Hold, and one Sell recommendations issued in the last three months. The average OKLO price target of $92.60 implies 16.21% downside from current levels.