The surge in demand for AI chips is now spilling over into the broader chip market. As companies race to build AI systems, they are pulling more production toward high-bandwidth memory, known as HBM. This shift is causing a shortfall in standard memory chips that power phones, computers, and many other everyday devices.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Memory makers such as Samsung Electronics (SSNLF), SK Hynix, and Micron Technology (MU) have been redirecting factories to meet rising orders for AI customers. As a result, prices for regular memory parts have soared. Industry data shows DDR4 memory spot prices jumped nearly 10% in a week, while some older memory types are up by more than 100% compared with a year ago.

Rising Costs Hit Device Makers

The price increases are now reaching manufacturers and consumers. Samsung has told clients it will lift DRAM prices by 15% to 30% and raise NAND flash prices by 5% to 10% later this year. Micron has also raised its prices by 20% to 30% and even stopped quoting some products. At the retail level, memory kits that cost $25 to $30 early this year now sell for around $80 to $100. British computer maker Raspberry Pi said memory costs are up about 120% from last year.

The squeeze comes as companies across the supply chain try to stock up before costs climb further. Analysts describe the buying pattern as “panic buying” as many firms race to secure parts. The tight supply also affects automakers, which use chips in nearly every new vehicle. Many suppliers have paused new quotes or raised prices to protect their inventory.

Longer Shortage Ahead

Unlike past chip cycles that lasted three or four years, analysts now expect this shortage to last longer. It takes at least two and a half years to bring new memory factories online, and most capacity today is tied up in AI production. Samsung and SK Hynix together make about 70% of the global DRAM supply, and both are moving faster toward newer DDR5 and HBM products.

At the same time, U.S. trade limits have made it harder for Korean and Taiwanese firms to manage factories in China. Samsung makes roughly 30% of its NAND chips there, while SK Hynix makes about 37% of its NAND and 35% of its DRAM in China.

Market Impact

The result is what some analysts now call a “super cycle” for memory chips. Prices of DRAM have nearly tripled from a year ago, while inventories are down to about eight weeks of supply, compared with more than 30 weeks two years ago. Analysts at KB Securities believe that if current trends continue, standard DRAM could become more profitable than HBM next year.

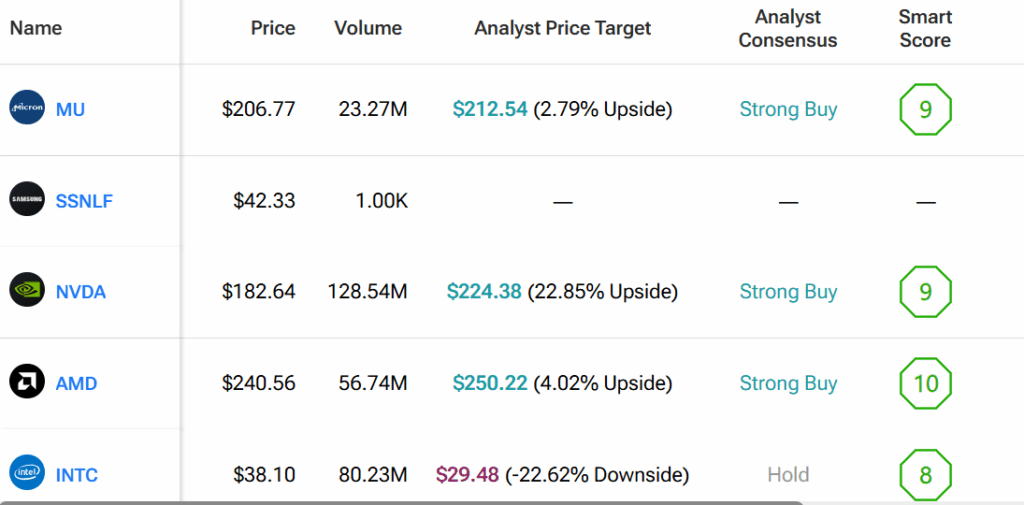

By using TipRanks’ Comparison Tool, we’ve lined up all the major chipmakers in the industry to gain a broader perspective on each of the stocks and the chip industry as a whole.