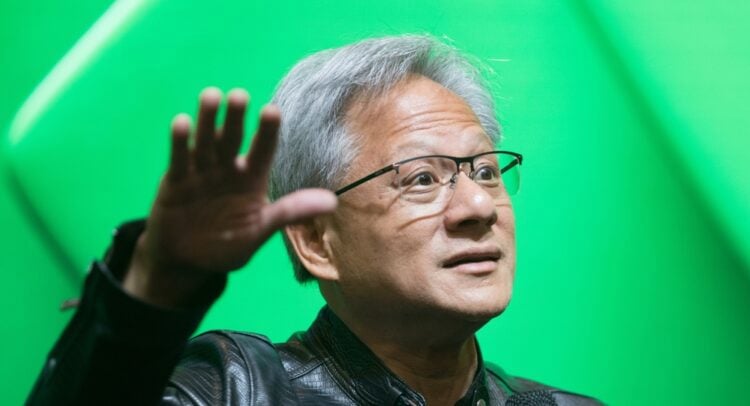

Nvidia (NVDA) stock surged 2.2% on Wednesday after CEO Jensen Huang declared that the demand for AI computing has grown “substantially” in the last six months. His comments helped offset concerns about the AI bubble, pushing AI stocks such as Super Micro Computer (SMCI) and AMD (AMD) up 6.6% and 11.4%, respectively.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Speaking on CNBC‘s Squawk Box, Huang attributed the intense appetite for AI chips to the rapid advancements in model capabilities. He said that the computing demand is not only due to the high-power needs of AI reasoning models but also because of rapid growth in model capabilities.

He noted, “The AIs are smart enough that everybody wants to use it. We now have two exponentials happening at the same time.”

Also, Huang noted that demand for Blackwell, Nvidia’s most advanced GPU, is “really, really high,” adding, “I think we’re at the beginning of a new buildout, beginning of a new industrial revolution.”

Huang Warns of a Key Bottleneck

Despite rising demand, Huang acknowledged a key bottleneck: energy supply. The massive scale of the AI infrastructure being planned has raised concerns about power consumption.

To meet this escalating demand and protect consumers from high electricity bills, Huang stated that the AI industry must build new power generation facilities “off the electric grid.”

Looking to the future, he suggested that data centers should be equipped to run on natural gas and, eventually, nuclear power to ensure a stable and sufficient energy supply.

Further, Huang warned that the U.S. is “not far ahead” of China in the AI race, citing China’s rapid advancements in energy infrastructure, domestic chip development, and quick adoption of AI applications. He noted China is “well ahead” in building power infrastructure for large-scale AI and has advanced domestic AI chip startups.

Which AI Stock Is the Better Buy?

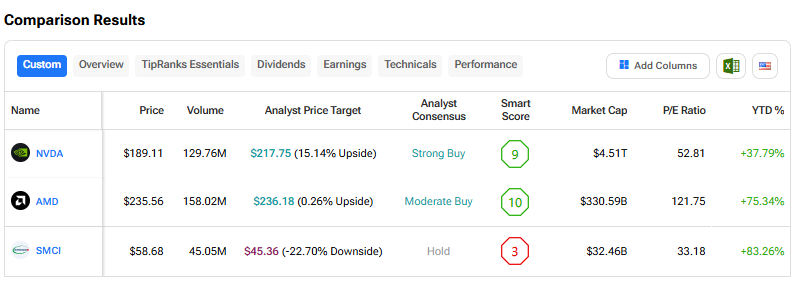

Out of the stocks mentioned above, analysts think that NVDA stock has the most room to run. In fact, Nvidia’s average price target of $217.75 per share implies more than 15% upside potential. On the other hand, analysts expect a downside risk of 22.7% from SMCI stock.