Shares of Agilent Technologies (NYSE:A) declined over 7% in Tuesday’s extended trading session, even as the maker of laboratory equipment surpassed analysts’ expectations for the fiscal second quarter. Investors were disappointed, as the company issued lackluster guidance for the fiscal third quarter and lowered the full-year outlook, citing an increasingly challenging market.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Agilent’s revenue for the fiscal second quarter (ended April 30, 2023) grew 6.8% year-over-year to $1.72 billion. Adjusted EPS increased 12.4% to $1.27 due to higher revenue and a 30 basis points expansion in the operating margin. The quarter benefited from the solid performance of the pharma as well as chemicals and advanced materials businesses. Analysts expected revenue of $1.67 billion and adjusted EPS of $1.26.

Despite the upbeat fiscal second-quarter results, Agilent now expects its full-year revenue in the range of $6.93 billion to $7.03 billion, compared to the previous outlook of $7.03 billion to $7.10 billion. The company projects FY23 adjusted EPS in the range of $5.60 to $5.65, down from the prior guidance of $5.65 to $5.70.

During the Q2 earnings call, CFO Robert McMahon explained that the revised outlook reflects a “more constrained capital market,” which is mainly expected to impact the company’s instruments business. McMahon added that from an end-market perspective, the pharma market is expected to be impacted the most. Agilent is now projecting full-year growth of low single digits for its pharma business, down from high single digits.

For the fiscal third quarter, Agilent sees revenue between $1.640 billion and $1.675 billion and adjusted EPS in the range of $1.36 to $1.38. The fiscal third-quarter outlook fell short of analysts’ expectations of EPS of $1.43 on revenue of $1.77 billion.

Is Agilent a Good Stock to Buy?

Following the Q1 print, Goldman Sachs analyst Matthew Sykes slashed his price target to $141 from $165 but maintained a Buy rating on Agilent. The analyst lowered his price target to reflect the risks related to macro challenges and moderate growth in the company’s instruments business.

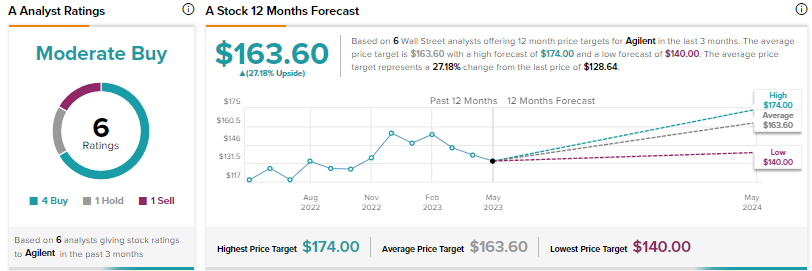

Wall Street’s Moderate Buy consensus rating on Agilent is based on four Buys, one Hold, and one Sell. The average price target of $163.60 implies 27.2% upside.