Electric vehicle maker Tesla (NASDAQ:TSLA) is anticipated to layoff additional employees in the first quarter of 2023, Electrek reported, citing a “reliable” source familiar with the matter. The company is reportedly going to freeze hiring as well. Back in June, Tesla CEO Elon Musk stated that the company would reduce its salaried workforce by about 10% over the next three months.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The news of layoffs comes at a time when investors and Wall Street analysts, including Tesla bulls, are increasingly concerned about the impact of Musk’s Twitter distraction on Tesla. In November, Bloomberg reported that Musk plans to cut 3,700 jobs at Twitter to cut costs. On Tuesday, Musk tweeted that he would step down as CEO of Twitter once he finds someone “foolish enough” to head the social media platform. Nonetheless, he intends to handle the software and server teams at Twitter.

Tesla Under Pressure

Aside from the Twitter issues, analysts are also bothered about the impact of weakness in demand in China, the world’s largest EV market, on Tesla’s deliveries next year. Tesla has slashed the prices of its EVs to boost its volumes in China.

Meanwhile, Musk recently blamed the decline in Tesla stock on macro factors. In a reply to long-time Tesla investor Ross Gerber, Musk tweeted, “As bank savings account interest rates, which are guaranteed, start to approach stock market returns, which are not guaranteed, people will increasingly move their money out of stocks into cash, thus causing stocks to drop.”

Gerber, CEO of Gerber Kawasaki Wealth & Investment Management, had tweeted about the fall in TSLA stock price due to the lack of leadership and stated that its “Time for a shake up.” Tesla stock has plunged nearly 61% year-to-date.

What is the Target Price for Tesla Stock?

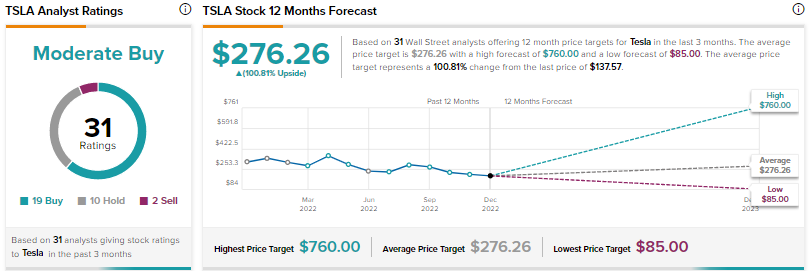

Wall Street is cautiously optimistic about Tesla stock, with a Moderate Buy consensus rating based on 19 Buys, ten Holds, and two Sells. The average TSLA stock price target of $276.26 implies nearly 101% upside potential.