Crypto exchange Bybit has decided to exit Canada due to the tightening regulatory environment in the country following the implementation of new guidelines earlier this year. Bybit’s exit comes days after Binance announced that it was withdrawing from Canada, as the latest guidance related to stablecoins and investor limits makes the country no longer “tenable” for the crypto exchange currently.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

“In light of recent regulatory development, Bybit has made the difficult but necessary decision to pause the availability of our products and services,” said Bybit in a statement.

Bybit, one of the world’s most visited crypto exchanges, said that the company will not be opening any new accounts in Canada from May 31. Existing customers will have time until July 31 to make new deposits or enter into new contracts or increase any of their existing positions for all products and services. After July 31, they can withdraw or reduce their positions.

The company added that Canadian customers have time until September 30 to wind down their positions, failing which the products will be liquidated and the liquidated funds will be made available for withdrawal.

Increased Scrutiny

The FTX debacle and the collapse of other crypto entities have triggered a heightened regulatory crackdown on the crypto markets in the U.S., Canada, and several other countries to protect investors’ wealth. Under Canada’s new regulations, crypto asset trading platforms are required to obtain approval from the Canadian Securities Administrators (CSA) and face rigorous due diligence checks.

Bybit recently opened its global headquarters in Dubai and is expanding into new markets. This week, the company said that it received approval from regulators in Kazakhstan. Earlier this month, Bybit announced that its global user base has expanded 50% from 10 million users in Q3 2022 to 15 million.

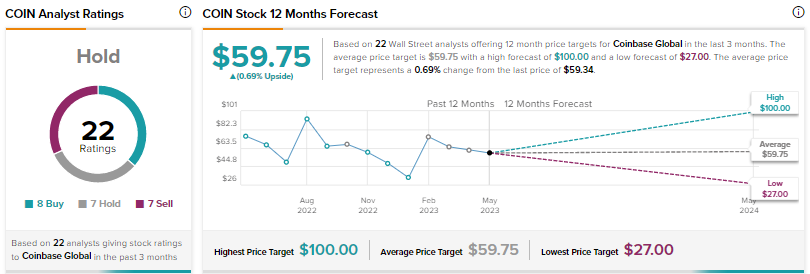

Aside from Bybit and Binance, OKX and dYdX have also exited the Canadian crypto market. Meanwhile, Coinbase Global (NASDAQ:COIN), which is at loggerheads with the U.S. Securities and Exchange Commission (SEC), continues to operate in Canada. Wall Street is sidelined on Coinbase, with a Hold consensus rating based on eight Buys, seven Holds, and seven Sells. The average price target of $59.75 indicates that the stock could be range-bound over the near term. COIN shares have rallied more than 70% since the start of 2023.