Digital operations management firm PagerDuty (NYSE:PD) offers an innovative solution in a market driven by rising demand. Despite recent positive financial results, the company gave unexpected guidance for diminished results in the near future, and the share price quickly reacted to the news, shedding over 5% in a day. While there is cautious optimism about the company’s ability to overcome this hurdle and resume future growth, PD stock’s current valuation suggests investors can wait for a lower price point and confirmation on the turn before taking action.

How’s Your Tech Stack?

PagerDuty is a player in digital operations management, offering an integrated incident management solution. The company’s platform efficiently collaborates with IT Ops and DevOps monitoring stacks to enhance operational reliability and agility. By combining machine-generated data from a multitude of software-enabled systems with human response information, the platform can identify and address issues and opportunities in real-time.

The DevOps market is experiencing significant growth, driven by the rising demand for increased productivity, high-quality software delivery, and cost-effective operations. The growing necessity for cutting-edge technologies to optimize businesses further fuels this expansion.

A survey of various third-party research on the market suggests the global DevOps Market is projected to reach $9-$10 billion by the end of 2023 and continue to grow with a CAGR of 19%-22% over the next few years.

Recent Results and Future Outlook

PagerDuty reported revenue of $111.1 million in Q4 2023, a 10.1% year-over-year improvement, beating the Street consensus forecast of $110.7 million. In addition, the company’s annual recurring revenue (ARR) rose to $451.9 million, marking an increase of 10% compared to the previous year.

The company’s adjusted earnings were reported at $0.17 per share, which beat the consensus estimate of $0.15 per share.

However, for the coming first quarter, PagerDuty expects adjusted EPS to be between $0.12 to $0.13 on revenue in the range of $110.5 million to $112.5 million. According to the company, an accounting issue will result in an increased effective tax rate of 22%-23%, impacting Fiscal 2025 by approximately $0.15.

Where the Stock Stands Now

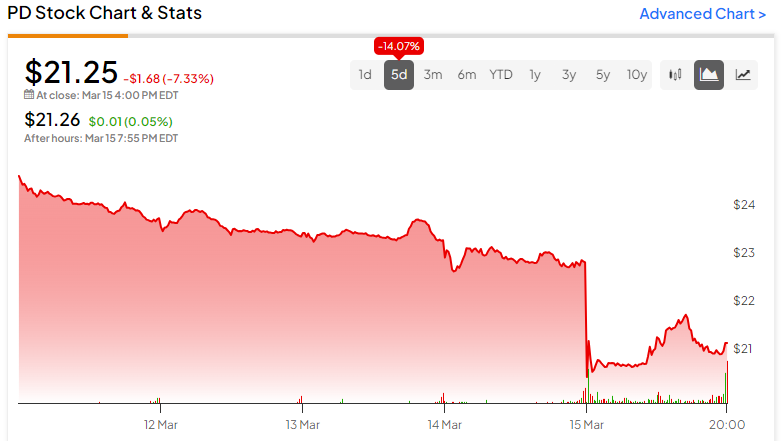

Despite exceeding estimates for the previous quarter, PD stock experienced a considerable dip, dropping over 5%, following the company’s downgraded future guidance. With the last closing price of $21.25, PD is trading toward the lower end of its 52-week range of $19.18-$35.33. The shares have shown ongoing negative price momentum and now trade below the 20-day (23.79) and 50-day (23.75) moving averages.

Despite the recent price decline, PD stock trades in relatively fair-to-slightly undervalued territory. Its price-to-sales ratio of 4.64x is in line with the Technology sector average of 4.61x, though a bit below the Software-Application industry average of 6.97x.

Cathie Wood’s ARK Investment Management is the most recent institutional acquirer of PD shares and is now the largest shareholder, holding over 20% of the outstanding shares. Such a significant position highlights the risk posed to the share price if a large shareholder decides to exit their holdings quickly.

What is the Price Target for PD in 2024?

Analysts covering Pagerduty stock have taken a cautiously optimistic view. For instance, Morgan Stanley’s Sanjit Singh recently reduced the price target from $30 to $24, yet maintained a Hold rating. He recognizes the business is currently experiencing a slowdown but maintains there are hopeful signs of growth in the near future, such as improved pipeline conversion, heightened sales productivity, and increased multi-product adoption.

PD is currently listed as a Hold based on eight analysts’ stock ratings in the past three months. The average PD price target of $25 represents an upside potential of 17.65% from current levels.

The Big Picture for PD

There are a number of things to like about PagerDuty – an innovative approach to integrating machine-generated data with human response, tailwinds from a market that exhibits robust growth potential, and recent performance that exceeded expectations.

That said, the market doesn’t like surprises (at least not the bad kind), and that is what it got with the company’s unexpectedly diminished forecast through 2025. With ongoing negative price momentum and a fair valuation at current levels, investors would be wise to look for a break in the downward trajectory of the share price, along with evidence of an operational upturn from the company, as a reasonable entry point.