Shares of American Eagle Outfitters (NYSE: AEO) surged in pre-market trading on Tuesday after the lifestyle, clothing, and accessories retailer exceeded analysts’ estimates on both the top line and bottom line.

Total net revenues for AEO, declined 3% year-over-year to $1.2 billion but beat Street estimates by $30 million.

AEO reported diluted earnings of $0.42 per share versus $0.74 in the same period last year and coming in ahead of analysts’ estimates of $0.22.

Interestingly, AEO’s women’s clothing brand Aerie delivered record Q3 revenues and operating profit.

AEO’s brand, Aerie posted revenues of $350 million, up 11% year-over-year and indicating a three-year Compounded Annual Growth Rate (CAGR) of 24%.

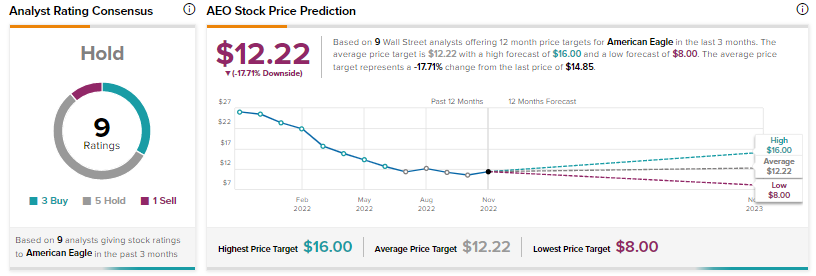

The above graphic indicates that Wall Street analysts are sidelined about AEO stock with a consensus Hold rating based on three Buys, five Holds, and one Sell.

For Q4, AEO expects brand revenue to decline in the “mid single digits” and has forecasted gross margin “in the range of 32% to 33%, at the higher end of previous guidance.”