Aemetis (NASDAQ:AMTX), a player in the renewable fuels and biochemicals sector, is committed to replacing traditional petroleum-based products with groundbreaking technologies. While recent financials have fallen short of expectations, the company just received a boost that will help it deliver a range of eco-friendly initiatives, including a significant sustainable aviation fuel production plant. The stock’s rich valuation reflects the firm’s ambitious five-year plans. ESG investors take note.

Eco-Friendly Fuels

Aemetis is a company that specializes in renewable fuels and biochemicals. Its primary focus is replacing traditional petroleum-based products with innovative technologies. The company operates in two key geographical regions: North America and India.

Aemetis recently secured $200 million in funding from the U.S. Citizenship and Immigration Services. The funds will bolster the company’s eco-friendly initiatives, including the Riverbank sustainable aviation fuel (SAF) production plant. The Riverbank plant in California is a dairy-renewable natural gas project slated to produce 78 million gallons of SAF annually.

Further, the Riverbank plant is structured to produce 90 million gallons per year when 50% capacity is allocated to SAF and 50% to renewable diesel production. Aemetis has already confirmed contracts worth over $3 billion to supply airlines with SAF.

Forging Ahead with a Five-Year Plan

Aemetis recently missed expectations, reporting Q4 EPS of -$0.64, vs. consensus of -$0.39. Its revenue of $70.8 million marked a notable increase compared to the $66.7 million revenue in Q4 2022, though still short of the estimated consensus of $74.65 million. The total revenue for the year 2023 was $186.7 million.

Aemetis has unveiled an updated five-year strategic plan, forecasting that the company will generate $1.95 billion in revenue and $645 million of adjusted EBITDA in 2028. The plan anticipates revenue growing at a compound annual growth rate (CAGR) of 38% and adjusted EBITDA growing at a projected CAGR of 83% between 2024 and 2028.

This ambitious plan hinges on successfully executing multiple initiatives, including 75 dairies producing renewable natural gas (RNG) by 2028, the operation of the Riverbank plant, and the completion of various energy efficiency and carbon reduction projects at the company’s Keyes biofuels plant.

Where Shares of AMTX Stand Now

AMTX stock has been trending up over the past year, climbing over 89%, though that trend has seen healthy bouts of volatility along the way. It is trading near the middle of the 52-week range of $1.16-$8.99 and currently demonstrates positive price momentum, bullishly trading above the 20-day (3.34) and 50-day (3.61) moving averages.

With the sustained run-up in price, the stock trades at a relative premium. Its P/S ratio of 1.05x is above the Energy sector average of 0.8x, the Oil & Gas Refining & Marketing industry average of 0.33x, and the stock’s historical average of 0.87x.

Is AMTX a Good Stock to Buy?

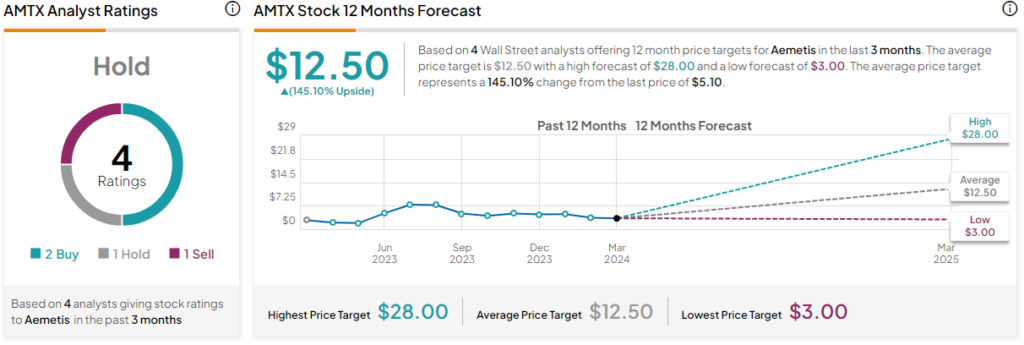

Analysts covering AMTX stock have taken a cautiously optimistic stance. For instance, H.C. Wainwright analyst Amit Dayal recently reiterated a Buy rating with a price target of $28, citing the company’s strong 2023 performance, key milestones, and the anticipated revenue increase of about 17.6% CAGR from 2024 to 2033. He also acknowledged the potential risks of missing those targets.

AMTX is currently listed as a Hold based on four analysts’ stock ratings in the past three months. The average AMTX stock price target of $12.50, on a wide range of $3-$28, represents an upside potential of 145.10% from current levels.

Risks and Rewards of AMTX

Companies like Aemetis are paving the way for a more sustainable energy future. Although recent revenue figures fell short of consensus estimates, the company’s strategic expansion into high-margin ethanol sales and biogas networks, the financial backing from the U.S. Citizenship and Immigration Services, and secured contracts worth over $3 billion depict promising potential for consistent growth.

Nevertheless, investors should also consider the inherent risks involved, such as the company’s ability to meet its ambitious five-year targets and the rich current valuation. Overall, AMTX stock is an opportunity for ESG investors who believe in the cause, don’t mind paying a premium, and are willing to ride out the bouts of volatility.