Autodesk (NASDAQ:ADSK) jumped in pre-market trading after better-than-expected Q4 results and an upbeat outlook. The software company reported adjusted earnings of $2.09 per share compared to $1.86 in the same period last year. This beat consensus estimates of $1.95 per share.

The firm saw its Q4 revenues increase by 14% year-over-year on a constant currency basis to $1.47 billion, surpassing analysts’ estimates of $1.43 billion. Autodesk’s total billings declined by 19% year-over-year to $1.71 billion. The company’s remaining performance obligations (RPO) grew 13% year-over-year to $4 billion in the fourth quarter. ADSK defines current RPO as total revenue (including deferred revenues) expected over the next 12 months.

For the first quarter of FY25, the software company forecasted revenues in the range of $1.38 billion to $1.4 billion, with adjusted earnings of $1.73 to $1.78 per share. For FY25, the company projected revenues of $5.99 billion to $6.09 billion, while adjusted earnings are likely to land between $7.89 and $8.11 per share. The FY25 revenue forecast exceeded analysts’ estimates of $5.96 billion.

Is ADSK a Good Stock to Buy?

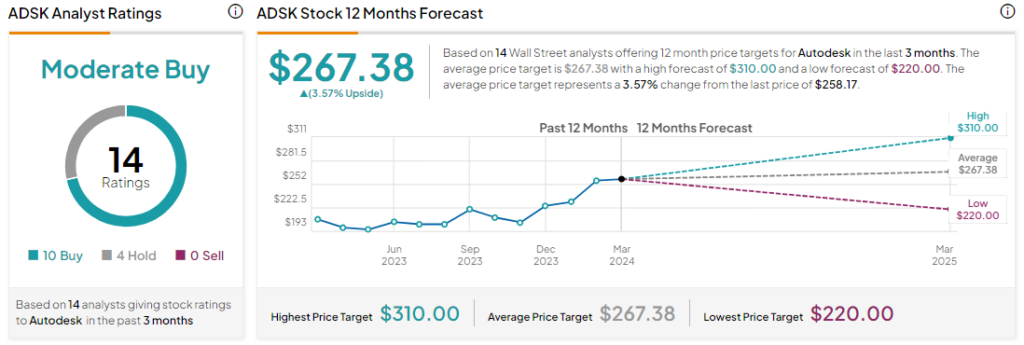

Analysts remain cautiously optimistic about ADSK stock with a Moderate Buy consensus rating based on 10 Buys and four Holds. Over the past year, ADSK has gained by more than 30%, and the average ADSK price target of $267.38 implies an upside potential of 3.6% at current levels. However, it’s worth noting that estimates will likely change following today’s earnings report.