Adobe (NASDAQ:ADBE) is slated to release its first quarter Fiscal 2024 results on March 14, after the market closes. The company’s performance might have benefited from a strong demand for its cloud offerings during the quarter. It is worth noting that Adobe’s web traffic increased year-over-year during the quarter, which suggests a positive scenario for its top line.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

ADBE is a multinational software company. Interestingly, ADBE stock has jumped nearly 79% in the past year, outperforming the Nasdaq 100 Index (NDX) rally of about 51%.

Encouraging Website Traffic Trend

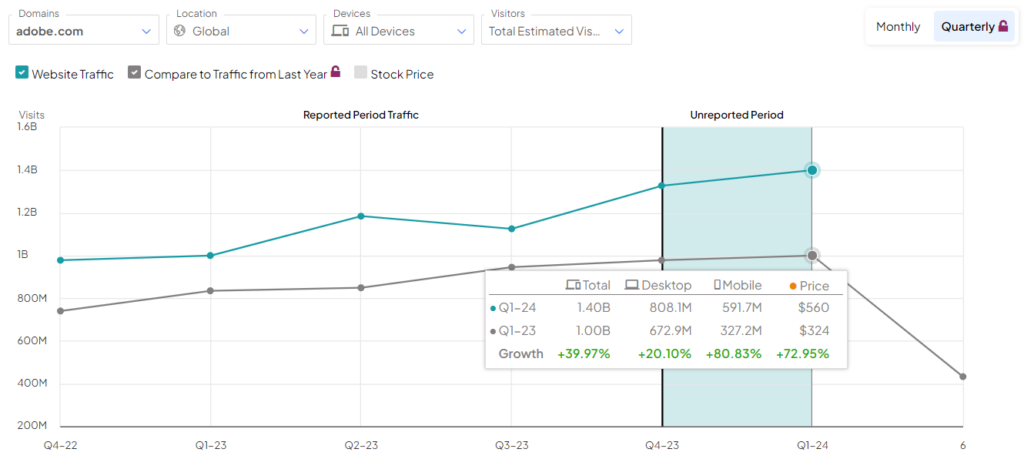

According to TipRanks’ Website Traffic tool, total visits to adobe.com grew by 39.97% year-over-year in Q1. The company’s website traffic jumped to 1.4 billion from 1 billion in the year-ago quarter.

The rising website traffic indicates that the demand for the company’s products remained strong during the quarter and might have supported top-line growth.

Learn how Website Traffic can help you research your favorite stocks.

ADBE – Q1 Expectations

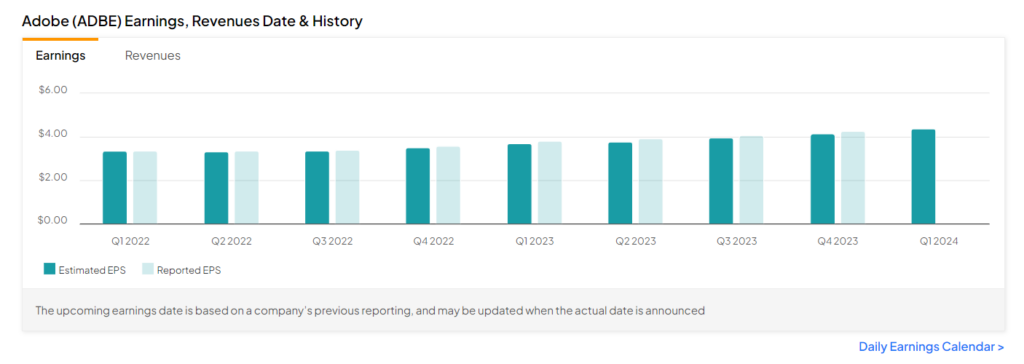

Wall Street expects Adobe to report sales of $5.14 billion in Q1, up 10.8% year-over-year. Further, the company is expected to post earnings of $4.38 per share, reflecting an increase of 15.3% from the year-ago quarter.

Interestingly, Adobe has a consistent history of delivering strong quarterly performances. The company surpassed earnings expectations for 15 consecutive quarters, indicating its potential to outperform estimates again in the to-be-reported quarter.

Analysts’ Opinions

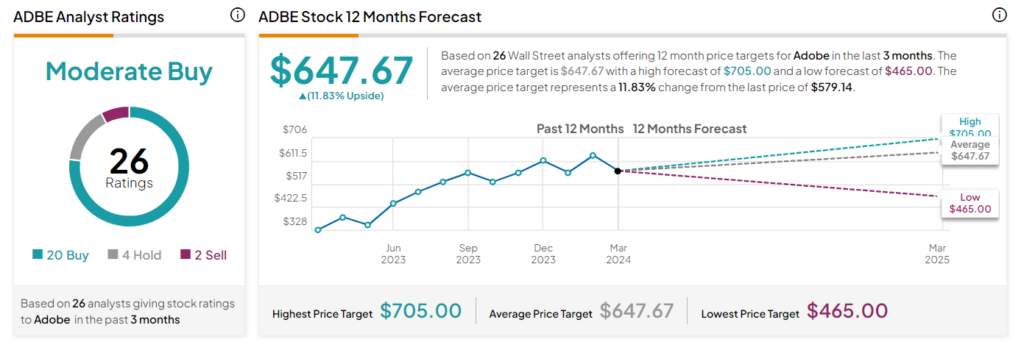

Ahead of the Q1 results, nine Wall Street analysts rated Adobe stock a Buy. Among the bullish analysts, BMO Capital analyst Keith Bachman believes the company has the potential to increase its user base with innovative features like Adobe Express and continued AI integrations.

Another analyst, Brent Thill, from Jefferies, expects ADBE to beat estimates in Q1. Thill expects the company to report robust revenues from the Digital Media segment. Furthermore, Thill believes that the company’s update on its artificial intelligence (AI) strategy should boost investor confidence.

Is Adobe a Buy, Hold, or Sell?

Wall Street is cautiously optimistic about Adobe. It has a Moderate Buy consensus rating based on 20 Buy, four Hold, and two Sell ratings. The analysts’ average price target on Adobe stock of $647.67 implies 11.83% upside potential.

Insights from Options Trading Activity

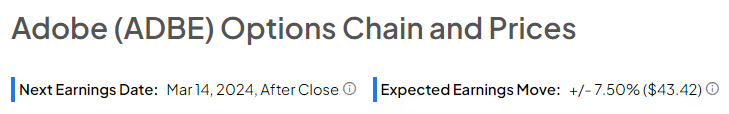

Options traders are pricing in a +/- 7.5% move on Adobe’s earnings, greater than the previous quarter’s earnings-related move of -6.35%.

The anticipated earnings move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.

Learn more about TipRanks’ Options tool here.

Concluding Thoughts

The company is expected to benefit from the strong momentum in the Digital Media unit. Moreover, Adobe is poised to attract new customers and witness substantial revenue growth with support from its AI tool, Firefly.