Multinational food processing company Archer-Daniels-Midland (ADM) announced that it has entered into a definitive agreement to acquire Sojaprotein, a leading European provider of non-GMO soy ingredients. The terms of the deal have not been disclosed so far.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Following the news, shares of the company gained marginally to close at $58.44 in the extended trading session.

With this acquisition, ADM is expected to strengthen its position in the meat alternative space and have a foothold in the European market. The company will also gain access to Sojaprotein’s extensive offerings in non-GMO vegetable protein ingredients.

The President of Global Foods at ADM, Leticia Gonçalves, said, “The addition of Sojaprotein — the largest producer of plant-based protein in southern Europe — adds production capacity in addition to an impressive network of customers who are leading the way in meeting consumer needs for nutritious and responsible plant-based foods and beverages.” (See ADM stock chart on TipRanks)

Recently, Jefferies analyst Robert Dickerson reiterated a Hold rating on the stock with a price target of $55. The analyst’s price target implies downside potential of 5.9% from current levels.

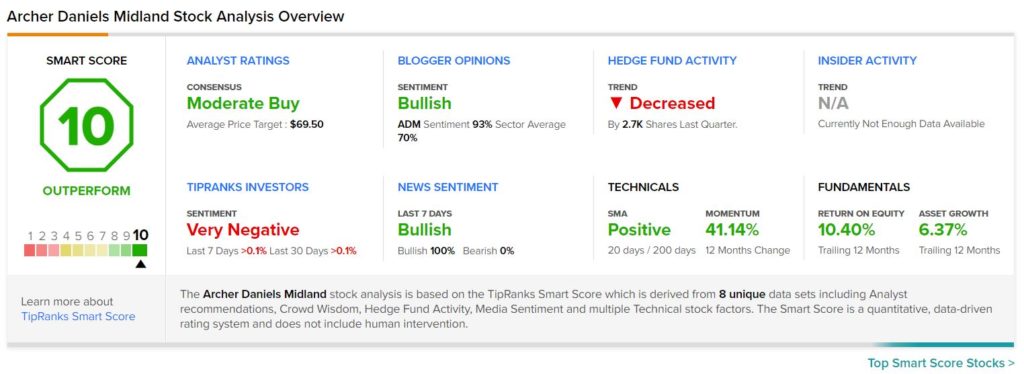

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus based on 7 Buys and 4 Holds. The average ADM price target of $69.50 implies 18.9% upside potential.

ADM scores a “Perfect 10” on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations. Shares have gained 38.7% over the past year.

Related News:

Meridian to Acquire Otsuka’s North American BreathTek Business for $20M

Lumen Expands Fiber Network Infrastructure in Europe

Cortexyme Develops 3CLpro Inhibitor to Treat COVID-19 Infection