More good news landed for video game market leader Microsoft (NASDAQ:MSFT) and its attempt to bring Activision Blizzard (NASDAQ:ATVI) into the fold. The Japan Fair Trade Commission (JFTC) removed one more stumbling block in its path, further clearing the way for the deal to go through. Activision rose a bit on the news in early trading but lost those gains and turned very slightly negative in Tuesday afternoon trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The Japan Fair Trade Commission noted that Microsoft’s plan to acquire Activision Blizzard would not—as many have suggested already—actually limit competition in video game console markets. Thus, the JFTC noted it wouldn’t release a cease and desist order, and its examination of the plan had officially concluded.

The U.K.’s equivalent, the Competition and Markets Authority (CMA), released a similar statement a few days back, provisionally approving though still investigating cloud gaming, while authorities in Brazil approved back in October. Chinese gaming is still a little hesitant, with both concern and positive feedback coming in.

Still, there are some holdouts, perhaps the biggest of which is the U.S.’s own Federal Trade Commission. Microsoft has been working to change minds, and the more countries that get on board, the more likely those holdouts are to pivot. However, with this ultimately poised to be the biggest takeover in gaming’s history, it’s clear that the scrutiny will be careful.

Given how many countries have completed said scrutiny and found the deal clean, though, more countries are likely to get on board lest their constituencies be angry about missing out.

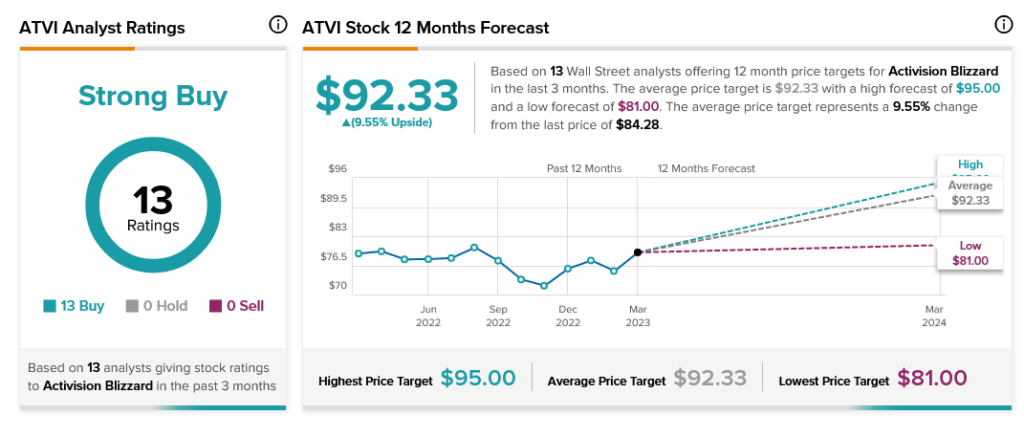

Analysts have no qualms about recommending Activision Blizzard. Currently, analyst consensus calls Activision Blizzard stock a Strong Buy based on 13 unanimous Buy recommendations. Further, Activision Blizzard stock’s average price target of $92.33 per share gives it modest upside potential of 9.55%.