The ongoing trouble between video game stocks Activision Blizzard (NASDAQ:ATVI) and Microsoft (NASDAQ:MSFT) merging and regulators around the world is still ongoing. Though, perhaps, some rays of hope emerge for anyone wanting Activision to end up a Microsoft product. That hope was enough to give Activision Blizzard stock a leg up in the market.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The UK’s regulators stepped in on the Activision / Microsoft merger, and that was enough to cut it off, at least in that country. However, Activision appealed, and that led to a new trial date which is set to start July 24. The trial may take as long as 10 days, noted a UK court, but it will more likely be over in just six days, one way or another. A CNBC report, meanwhile, noted that the judge in the UK case seems eager to get this trial underway, and that’s regarded as a positive move for the merger to ultimately go through.

The biggest problem in the UK seems to be issues of cloud gaming. The CMA noted that Microsoft currently holds between 60% and 70% of the cloud gaming market by itself. If Microsoft also manages to get three of the biggest cloud gaming titles–“World of Warcraft,” “Overwatch,” and “Call of Duty”–under its umbrella as well. This result would be a near-complete win for Microsoft. Microsoft, meanwhile, has four expert witnesses prepared to note that the CMA’s analysis is packed with “fundamental errors” that unduly skew the market in Microsoft’s favor when it really shouldn’t.

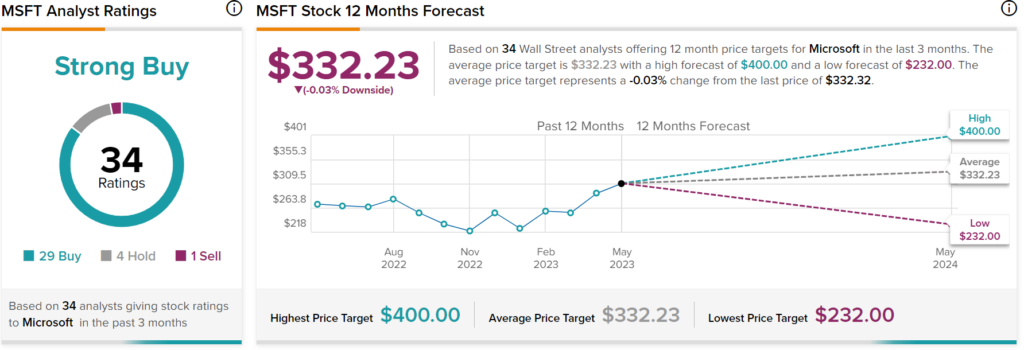

Turning to Wall Street, analysts have a Strong Buy rating on MSFT stock based on 29 Buys, four Holds, and one Sell. Nonetheless, with an average price target of $332.23, MSFT offers no upside potential for its investors, suggesting that the stock may be fully valued.