ACM Research, Inc. (NASDAQ:ACMR), a leading semiconductor equipment manufacturer, has shown remarkable sales growth in the past few years. With the shares up nearly 162% in the past year, the stock continues to show positive price momentum while still looking relatively reasonable in valuation. Despite potential risks like customer concentration and geopolitical challenges, analysts remain bullish on the company’s prospects. Growth-oriented investors might want to follow suit.

Impressive Revenue Growth

ACM Research develops and manufactures single-wafer wet cleaning equipment used extensively in the semiconductor manufacturing industry to remove particles and other defects and enhance product yield.

The superior yield and cost-efficiency of the company’s products have led to their widespread adoption, particularly by mature node foundries in China, where ACM enjoys a 30% to 40% market share.

ACM has capitalized on the surge in semiconductor demand, fueled by multiple sectors, including automotive, cloud computing, and artificial intelligence. The company’s sales have seen an impressive CAGR of 27% since 2021, making it one of the fastest-growing companies in the semiconductor equipment sector. Further, ACM expects its revenue to reach between $650 million and $725 million in 2024, implying a growth rate of about 17% to 30%.

Risks to Consider

ACM faces significant customer concentration risk, with three customers (SMIC, SiEn, and CXMT) collectively constituting 46% of the total revenue.

Also, the predominance of ACM’s customer base in Mainland China introduces international geopolitical risks that could impact expansion efforts, particularly if the U.S. becomes even more increasingly wary of collaborating with China-based tech companies (a non-trivial possibility given the election cycle and potential for a new administration or change in party control).

ACMR’s Valuation and Other Aspects

ACMR stock shows positive momentum, trading toward the higher end of its 52-week range of $8.75-$34.40. Despite the price increase, the stock still looks reasonably valued.

Valuation ratios suggest the company is relatively undervalued. ACMR’s PE ratio of 24.98x compares favorably with the Sector (Technology) and Industry (Semiconductor Equipment & Materials) averages of 32.40x and 38.42x. Other valuation multiples like EV to EBITDA, Price to Sales ratio, and Price to Book Value ratio also indicate that the stock is undervalued.

Coming to technical indicators, the stock is trading above the 20-day moving average price of $24.12 and a 50-day moving average price of $21.09. The upward price momentum suggests the stock may continue to see a positive price movement in the near future.

What is the Target Price for ACM Research Stock?

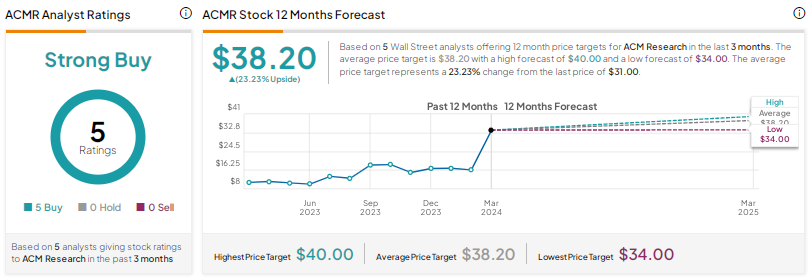

Wall Street analysts have been quite bullish on the stock. Most have raised their price targets based on the strength of Q4 results. They also expect continued success for the company in 2024 based on the recovery of DRAM equipment sales, increased sales through strategic investments in Korea, sales from advanced packaging tools, and sales expansion beyond China.

ACMR scores a Strong Buy consensus rating based on five Buy recommendations by analysts in the past three months. The average price target of these analysts is $38.20, with a range of $34.00-$40.00. This price target represents 23.23% upside potential from current levels.

Final Analysis

ACM’s ability to consistently grow sales and earnings at an above-average rate, combined with a positive revenue forecast, positions it well for future success. Moreover, the reasonable valuation ratios indicate that the stock may be undervalued relative to its growth potential.

While there are some risks, ACM appears well-positioned for investors looking for growth-oriented investments with a prudent valuation.