Things weren’t looking good for IT consultant Accenture (NYSE:ACN) for a while there. Its share price was in open freefall after its first quarter numbers failed to impress investors, even as it hiked its dividend. But new word from Baird gave Accenture a little extra life, even if Accenture itself isn’t so sure how well that will work out.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The word from Robert W. Baird, via analyst David Koning, noted that things weren’t quite so bad to begin with. Revenue was “…essentially in line with Street,” and earnings per share did well. Bookings were up, and there was a good chance of a “…back-end loaded year.” The end result wasn’t anything spectacular—Koning has a Neutral rating on Accenture and left it there, though he did hike the price target to $344 per share—but it was apparently good enough for at least a passing nod. There were concerns here, though; reduced discretionary spending in the face of a weakening economy might prompt reduced spending on IT services and consulting. However, the general rise in generative AI solutions might prove too good to pass up.

Even Accenture Isn’t That Sure

The downside to this, however, is that even Accenture itself doesn’t even quite believe Koning’s assessment. Word from Accenture CEO Julie Sweet is that most companies simply aren’t ready to put generative AI, or any other kind of AI for that matter, to work. They don’t have the necessary data infrastructure to carry out the job, Sweet notes. That may be an opportunity for Accenture and firms like it in and of itself, but with discretionary spending under fire as it is, the odds of complete IT overhauls going in are fairly slim. Indeed, even the technology itself may not be ready for prime time; Sweet described AI in general as “…in an experimental phase at most companies,” further noting that “…macroeconomic uncertainty is holding back IT spending generally.”

Is ACN a Good Stock to Buy?

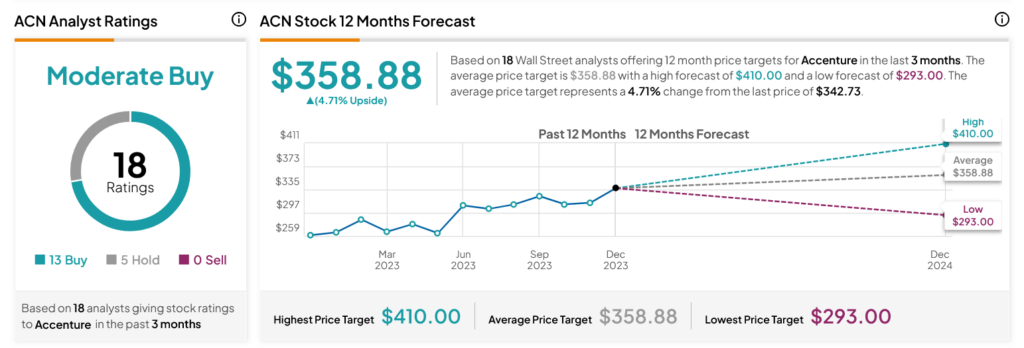

Turning to Wall Street, analysts have a Moderate Buy consensus rating on ACN stock based on 13 Buys and five Holds assigned in the past three months, as indicated by the graphic below. After a 29.8% rally in its share price over the past year, the average ACN price target of $358.88 per share implies 4.71% upside potential.