If you thought that mall-facing retailers were in for a disaster after what happened at Macy’s (NYSE:M), then you would not be alone. You would also, however, be very surprised because quite the contrary happened for Abercrombie & Fitch (NYSE:ANF). In fact, shares were up 23% at one point in Wednesday afternoon’s trading session thanks to dazzlingly defied expectations.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Abercrombie & Fitch not only turned in a winner of an earnings report, but their guidance also looked pretty sharp. The clothier turned in $1.10 per share for earnings, which destroyed analyst expectations of $0.15 per share. A similar beat was found in revenue, where Abercrombie & Fitch posted $935 million against analyst expectations calling for $843.97 million, representing a gain of 16.1% against the second quarter of 2022.

Abercrombie & Fitch also upped its outlook, looking for revenue to jump 10% over the $3.7 billion seen in 2022. That will put revenue nicely over analyst consensus calling for $3.84 billion, though it does assume that Abercrombie brands continue their wins over Hollister brands. Furthermore, inventories were kept at lean levels, and promotions helped drive sales. Also, new styles such as “dressier” outfits and “new denim silhouettes” also brought in customers as workplaces started relaxing dress codes to include jeans.

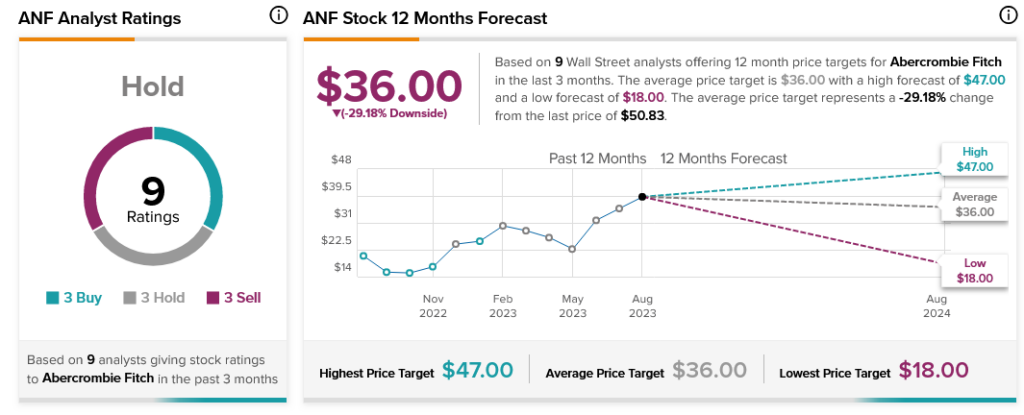

Analysts, however, are largely skeptical and evenly divided. With three Buy ratings, three Holds, and three Sells, Abercrombie & Fitch stock is considered a Hold by analyst consensus. Further, today’s price action put Abercrombie & Fitch stock in a bit of a bind, as its average price target of $36 now means it comes with a downside risk of 29.18%.