Switzerland-based ABB Ltd. (ABB) inked an all-cash deal to sell its Mechanical Power Transmission division (Dodge) to RBC Bearings Inc. (ROLL) for $2.9 billion. Shares of both companies hit their all-time highs following the news. ABB closed up 0.7% at $36.95, while ROLL jumped 16.2% to close at $240 on July 26. (See ABB stock charts on TipRanks)

ABB provides electrification, industrial automation, robotics and motion products, and RBC Bearings provides highly-engineered precision bearings and components.

ABB’s Dodge business engages in the design, production, and marketing of mounted bearings, enclosed gearing, and power transmission components to industries such as surface mining, aggregates & cement, warehousing, and food & beverage.

In the twelve months ended June 30, Dodge earned revenue of $600 million, 90% of which came from the Americas. The acquisition of the Dodge business will make RBC Bearings one of the leading manufacturers of highly engineered, performance-critical bearings and motion control components.

Dr. Michael J. Hartnett, RBC Bearings Chairman, President, and CEO, said, “Our businesses are highly complementary, with Dodge bringing new offerings, new end markets, and more scale to the combined organization. The combined company will have an attractive position in the Aerospace, Defense and Industrial markets with a diversified client base and expansive geographic footprint.”

The deal is expected to close by the end of the current year, subject to closing conditions. ABB expects to use the cash proceeds from the deal to fund its organic growth, enhance shareholder returns by paying sustainable dividends, and make strategic acquisitions.

Additionally, the company expects to book a one-time gain on sale of $2.2 billion on completion of the deal and related cash tax outflows of $400 million.

ABB is also looking to exit its Turbocharging business and spin off its E-Mobility business into a separate publicly traded company.

On July 22, ABB announced its second-quarter results, reporting revenue of $7.45 billion and earnings per share of $0.37.

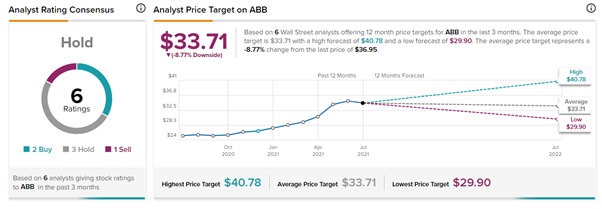

Following its quarterly results, Morgan Stanley analyst Ben Uglow maintained a Sell rating on the stock while lifting the price target to $30. This implies 18.7% downside potential to current levels.

Overall, the stock has a Hold consensus rating based on 2 Buys, 3 Holds, and 1 Sell. The average ABB price target of $33.71 implies 8.8% downside potential to current levels. Shares have gained 41.8% over the past year.

Related News:

Aon and Willis Towers Watson Terminate $30B Merger

OTIS Hits All-Time High on Strong Q2 Results; Raises Guidance

Why Has General Motors Been in the Spotlight Lately?