Recently, reports emerged that Foxconn was in dire straits because demand for electronics—including iPhones—was on the decline. Yet now, Wedbush’s own Dan Ives came out with a report that Chinese demand for iPhones is on the upswing. Apple (NASDAQ:AAPL) investors liked what they heard, at least provisionally, and sent Apple shares up fractionally in Wednesday afternoon’s trading.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Just two days ago, things were looking bad for Foxconn and, by extension, Apple. Foxconn noted that its February revenue was down 11.65% as compared to the same time the previous year. The reason for the loss was simple enough: fewer people were buying the electronics Foxconn produces. However, Ives noted that supply chain checks on Apple product makers revealed “…a modest uptick in demand coming out of China for Apple with a clear demand rebound happening…”

Furthermore, Ives said that there were “…no major unit cuts from suppliers in Asia around iPhone production yet, which is a good sign that shows a steady demand curve on the flagship iPhone 14 Pro…” Since smartphone sales made up a little better than half of Apple’s December quarter sales—$65.8 billion out of $117.2 billion total—paying close attention to smartphone sales is a sound indicator of Apple’s overall success.

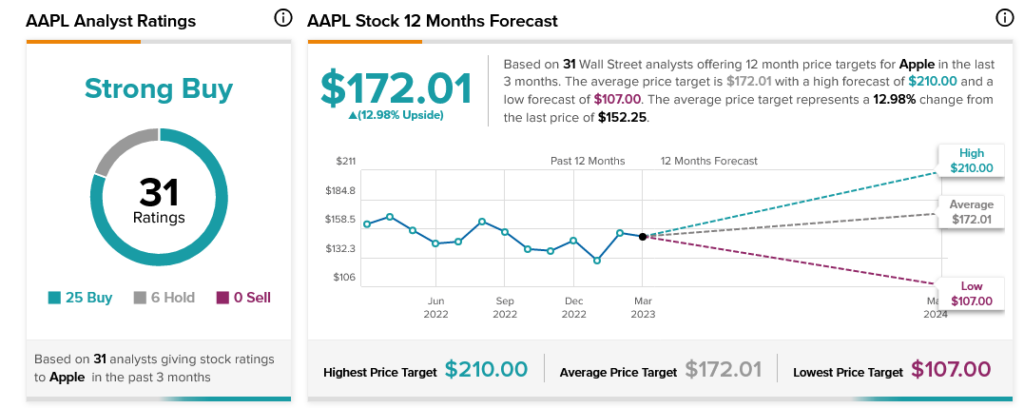

Overall, Apple has a Strong Buy consensus rating from analysts. Better yet, Apple stock has 12.98% upside potential thanks to its average price target of $172.01 per share.