Shares in U.S. tech giants Apple (AAPL) and Meta Platforms (META) were lower today as they were told not to ignore warnings from hedge fund veteran David Einhorn that their AI splurges may leave investors nursing huge losses.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Unprecedented Spend

Speaking at the New York Stock Exchange, Einhorn said that the unprecedented trillion-dollar spend on AI infrastructure, such as data centers, by the likes of Apple, Meta and OpenAI had reached “extreme levels.”

Although he believes that AI will continue to grow and evolve, he is uncertain as to whether the annual outlays of $500 billion to $1 trillion can generate strong returns for shareholders of the tech firms.

“The numbers that are being thrown around are so extreme that it’s really, really hard to understand them,” Einhorn said. “I’m sure it’s not zero, but there’s a reasonable chance that a tremendous amount of capital destruction is going to come through this cycle.”

Major investments include Apple’s $500 billion domestic investment pledge over the next four years with Meta’s Mark Zuckerberg and Sam Altman of OpenAI also flashing the AI cash.

Einhorn drew a sharp line between the long-term importance of AI and the immediate economics of funding it. He said many projects will be built, but investors may not see the payoffs they anticipate.

“When David Einhorn speaks, the markets should listen,” said Kathleen Brooks, research director at XTB. “He is the hedge fund manager who pulled the rug from underneath the subprime mortgage market boom in 2007/2008. His warning could be seen as a threat to the lofty valuations of Google (GOOGL), Meta and Microsoft (MSFT). They have pledged some of the largest investments in AI infrastructure and are Nvidia’s (NVDA) largest customers.”

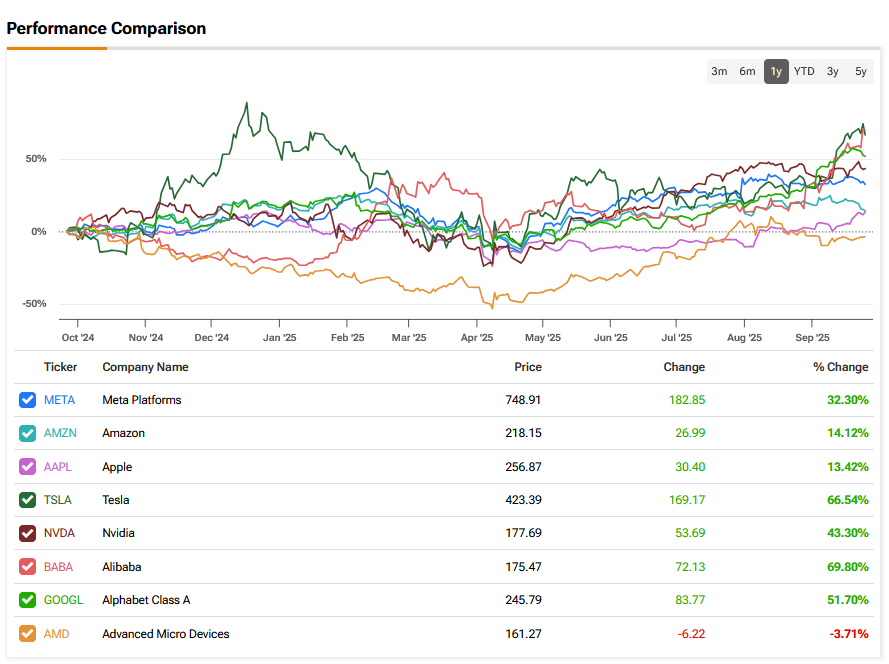

She warned that if the market starts getting nervous about the amount they are spending on AI it would not only hit their share prices, but also global stock markets. That feels some way off now, however, given the performance of the Magnificent Seven over recent months – see below:

“For now, these companies have strong revenues to justify their stock market valuations, but the focus will be on the effectiveness of their investments in AI, especially as we move towards Q3 reporting season,” she said.

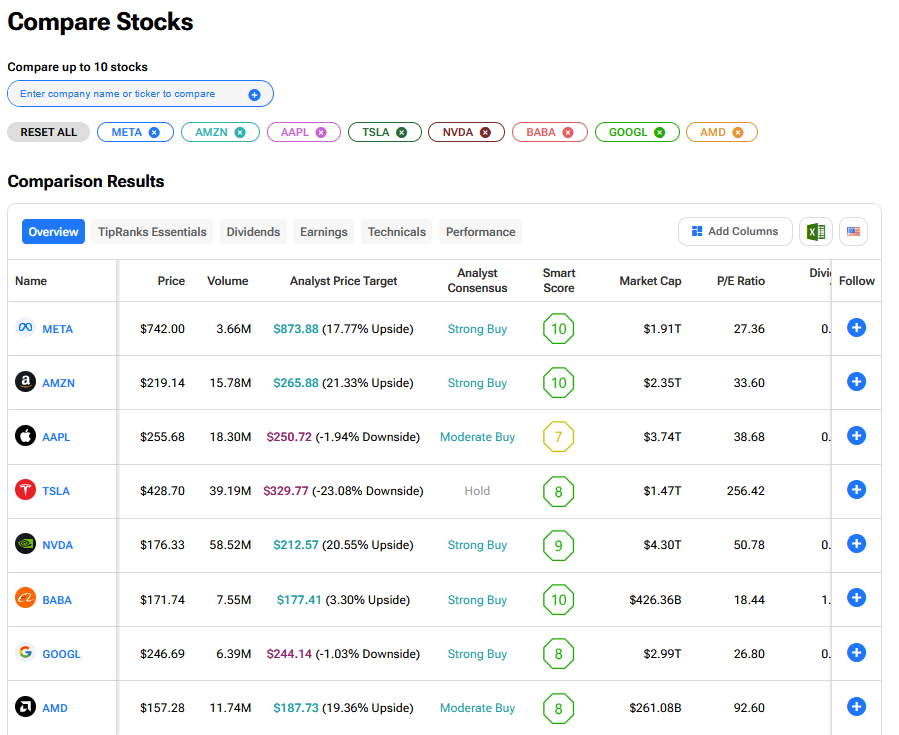

What are the Best AI Stocks to Buy Now?

We have rounded up the best AI stocks to buy now using our TipRanks comparison tool.