Shares of Apple (NASDAQ:AAPL) are lower today, which can be attributed to Foxconn’s weak demand forecast for smart consumer electronics in 2023. Foxconn’s management pointed to inflation and a slowing global economy as the catalysts for the weak outlook.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Apple’s own guidance seems to converge with that of its main manufacturing partner, as the company expects its year-over-year revenue performance for the current quarter to be similar to the December quarter’s year-over-year performance. This would imply a roughly 5% decline.

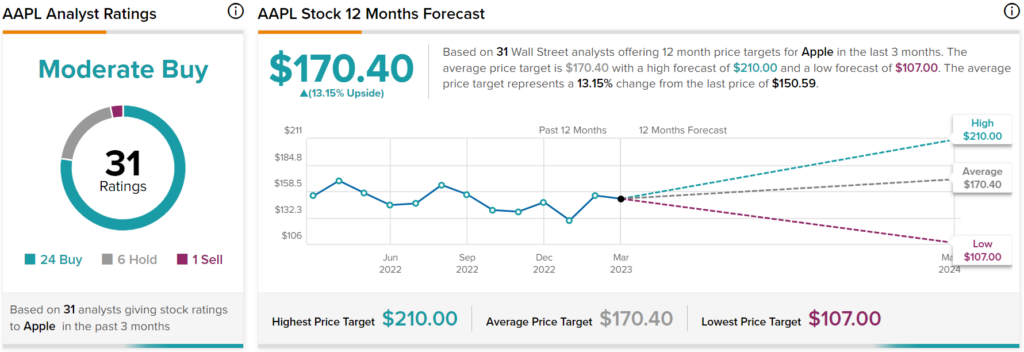

Overall, Wall Street analysts have a consensus price target of $170.40 on AAPL stock, implying over 13% upside potential, as indicated by the graphic above.