iPhone maker Apple (NASDAQ:AAPL) will release its Q2 financials on Thursday, May 2. The technology giant is facing challenges in driving sales across its product range, which will likely hurt its revenues and EPS in the second quarter. Analysts’ estimates indicate that the company’s top and bottom lines will likely decline in Q2.

Most Accurate Analyst Expects AAPL’s Revenue to Decline in Q1

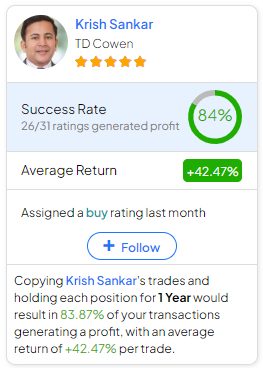

Before we delve into Q2 expectations, it is important to highlight that TD Cowen analyst Krish Sankar expects Apple’s revenue to decline by 5% in Q1. This reflects tough year-over-year comparisons for the iPhone and ongoing weakness in Mac and Wearables. In addition, the analyst sees mixed iPhone demand trends in China. Nonetheless, Sankar reiterated a Buy on Apple stock on April 29.

Investors should note that Sankar is the most accurate analyst covering Apple stock in a one-year timeframe, according to TipRanks. Copying Sankar’s trades on AAPL stock and holding each position for one year could result in 84% of your transactions generating a profit, with an average return of an impressive 42.47% per trade.

Apple: Q2 Expectations

Wall Street analysts expect Apple to report revenue of $90.37 billion in Q2, down about 5% from the prior-year quarter’s $94.8 billion. Softness in iPhone sales and expected declining Mac, iPad, and Wearables sales will likely remain a drag. Nonetheless, the momentum in Apple’s Services segment will likely sustain and support its overall sales.

A revenue decline will likely impact Apple’s bottom line in Q2. Analysts forecast Apple to report earnings of $1.51 per share, down from $1.52 in the prior-year quarter.

Is Apple a Buy, Hold, or Sell?

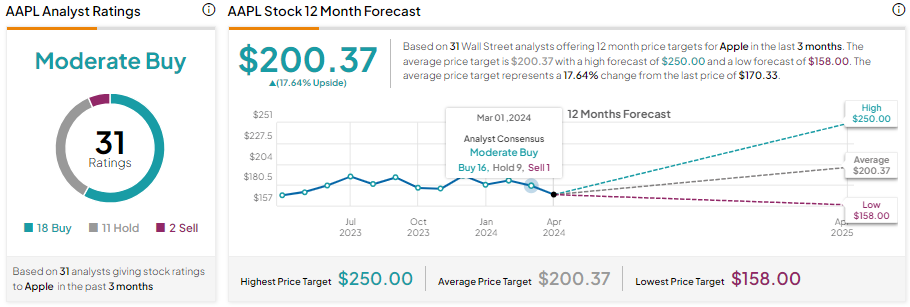

Apple stock is down about 11.4% year-to-date. Wall Street analysts are cautiously optimistic about Apple stock ahead of its Q2 earnings. With 18 Buy, 11 Hold, and two Sell recommendations, Apple stock has a Moderate Buy consensus rating. Analysts’ average price target on AAPL stock is $200.37, which implies 17.64% upside potential from current levels.

Insights from Options Trading Activity

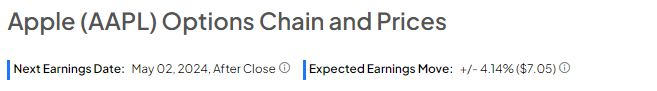

While analysts are cautiously optimistic about AAPL stock, options traders are pricing in a +/- 4.14% move on earnings, which is higher than the previous quarter’s earnings-related move of -0.54%.

The anticipated move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.

Learn more about TipRanks’ Options tool here.

Bottom Line

Apple is facing near-term headwinds that are expected to have adversely impacted its top and bottom lines during the second quarter. The ongoing challenges have kept analysts sidelined on AAPL stock ahead of the Q2 print.