Goldman Sachs’ (NYSE:GS) asset management arm, Goldman Sachs Asset Management (GSAM), has been charged by the Securities and Exchange Commission (SEC) for failure to follow ESG (Environmental, Social, and Governance) investment policies. GSAM agreed to pay a penalty of $4 million to the SEC to absolve the charges.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The asset management unit came under fire for failure to follow ESG policies and procedures for two of its mutual funds, multiple times between April 2017 and February 2020. More precisely, from April 2017 until June 2018, the company did not disclose any written policies and procedures for ESG research in one of the funds, as per the regulations. Once they were established, GSAM was found to have shirked from following them until February 2020.

The news comes amid a crackdown campaign by the SEC targeting firms that market their funds as ESG funds.

ESG-focused funds have, in recent years, attracted large amounts of capital inflows from investors as attention to environmental issues and workforce diversity gained traction. Andrew Dean, co-head of the SEC’s asset management overseeing unit, noted that the penalty should come as a reminder for investment advisers to take ESG procedures seriously to ensure that investors “receive the advisory services they would expect to receive from an ESG investment.”

Shares of Goldman Sachs are down 1% so far this year. The SEC charges have not yet deterred ESG-focused shareholders.

Is GS a Good Buy?

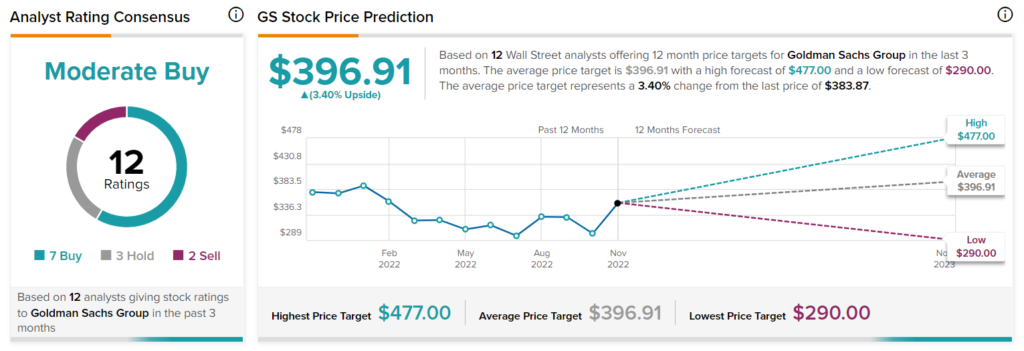

Goldman Sachs stock has a Moderate Buy rating from the analyst consensus on Wall Street, based on seven Buys, three Holds, and two Sells. The average price target for SG stock is $396.91, indicating an upside of 3.4%.