It was quite an achievement posted by Canadian telecom leader Rogers Communications (TSE:RCI.B) (NYSE:RCI). In fact, it was an achievement so grand it was the first time it had ever been seen in Canada. But despite this, that wasn’t enough to budge the share price up any, as investors piled out and lowered the share price somewhat in Thursday afternoon’s trading.

So what is the achievement in question? It’s the first ever satellite-to-mobile phone call. A combination effort of Rogers and Lynk Global, the technology allows for communications access in the most remote areas of Canada, or, roughly the entire northernmost 80% of the country, give or take. The duo will make the service commercially available starting in 2024, and when it does, will mean that users will be able to make calls in pretty much any location within Canada itself. The call, meanwhile, was staged via a pair of Samsung S22 phones, and even had a note of historical significance, taking place in Heart’s Content, where the first transatlantic telegraph took place over 150 years prior.

Planned Expansions

This is not the first bit of news out of Rogers we’ve heard lately, but merely, the latest. Recently, we heard about Rogers selling off its holdings in Cogeco, which freed up some cash for it to use to lower its debt and improve its leverage ratio. Beyond that, meanwhile, there’s also word that Rogers is looking to expand outward further into sports and real estate in a bid to diversify the business. Diversification isn’t a bad idea, within a certain limit; it helps improve resiliency and reduces the chance of a downturn hurting the entire business. Taken too far, it can split focus and cause resource shortages, but right now that doesn’t look to be an issue for Rogers as a whole.

Is Rogers Communications Stock a Good Buy?

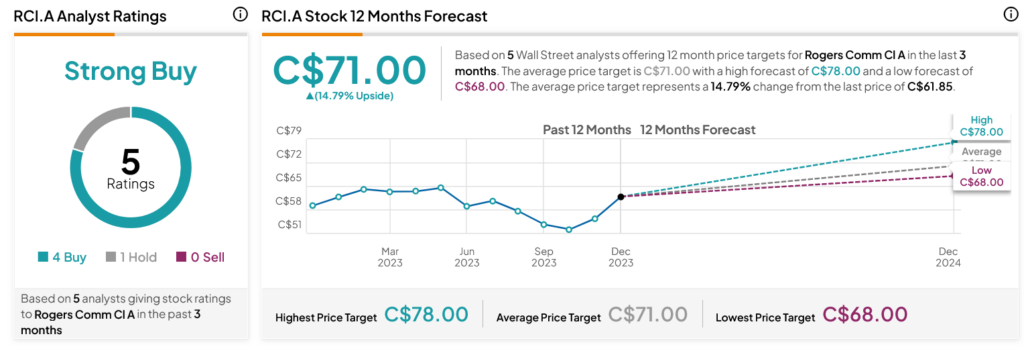

Turning to Wall Street, analysts have a Strong Buy consensus rating on TSE:RCI.B stock based on four Buys and one Hold assigned in the past three months, as indicated by the graphic below. After a 3.95% rally in its share price over the past year, the average TSE:RCI.B price target of $71 Canadian per share implies 14.79% upside potential.