Canadian telecom giant Rogers Communications (TSE:RCI.B) (NYSE:RCI) recently launched a move that left shareholders nonplussed but may have been the best move for it overall. Rogers shares were down fractionally in Tuesday afternoon’s trading after announcing that it would sell off all of its Cogeco Inc. shares (TSE:CGO) to Caisse de dépôt et placement du Québec.

The move would mean C$829 million for Rogers, which it plans to use to pay off debt and lower its overall leverage ratio. In turn, Caisse will wind up as an “anchor investor” in Cogeco’s cable and internet subsidiary operations. Caisse, a global investment group, already has about $424 billion in net assets under its management, so this represents a simple branching-out move into a likely reasonably profitable area.

Opportunity All-Around

As it turns out, this move proved to be a good opportunity on several fronts. Not just for Rogers, either; while Rogers definitely does well to reduce its debt load and take some of the recurring expenses of debt servicing off its plate, it’s not the only one who comes out ahead. Cogeco noted that it could, thanks to this deal, buy back some shares at an “attractive price” to allow it to better “…deliver our strategic plan.” Meanwhile, Caisse gets an opportunity to better develop its position in the North American market.

Is Rogers Communication Stock a Good Buy?

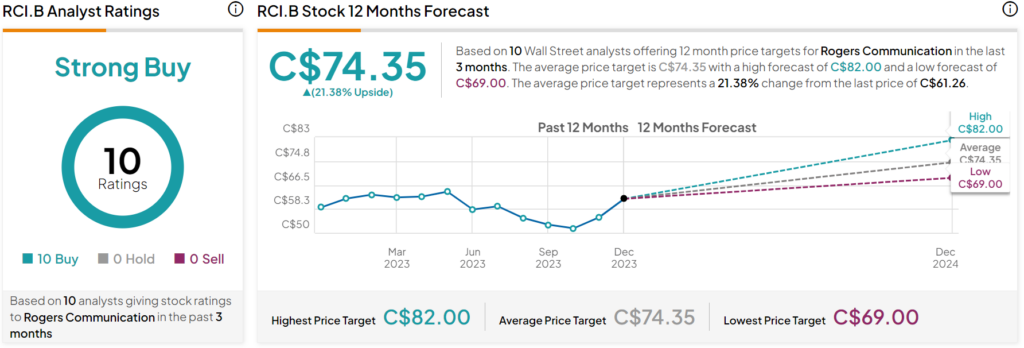

Turning to Wall Street, analysts have a Strong Buy consensus rating on RCI.B stock based on 10 Buys assigned in the past three months, as indicated by the graphic below. After a 4.69% rally in its share price over the past year, the average RCI.B price target of C$74.35 per share implies 21.38% upside potential.