While solar stocks haven’t been exactly doing wonders lately, JinkoSolar (NYSE:JKS) is having an absolutely brilliant day. Shares are up over 19% in Monday afternoon’s trading, as not only did JinkoSolar turn in a blistering earnings report, but it also offered insight on a new panel that’s got some impressive new capability as well.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

JinkoSolar has been up most of the morning and well into the afternoon, thanks largely to that killer earnings report and accompanying guidance. Revenue came in at an impressive $4.36 billion, which was well ahead of the consensus estimates looking for $4.19 billion. That revenue figure also represented at 63% jump against this time last year’s figures. Meanwhile, JinkoSolar also offered a thoroughly confident look into the rest of 2023, noting that it was, indeed, “confident” that it could beat previously-released guidance for the full year.

Reason enough for investors to take interest, certainly, but that wasn’t all that was on tap. In fact, JinkoSolar delivered another major development only recently as well. It recently revealed a new N-type solar cell that delivers 26.89% efficiency. JinkoSolar had the efficiency rate verified by a third party, reports note, and the achievement has indeed been verified. That’s actually a company record as well, reports note, which may give JinkoSolar a little extra push in the field.

Is JinkoSolar a Good Stock to Buy?

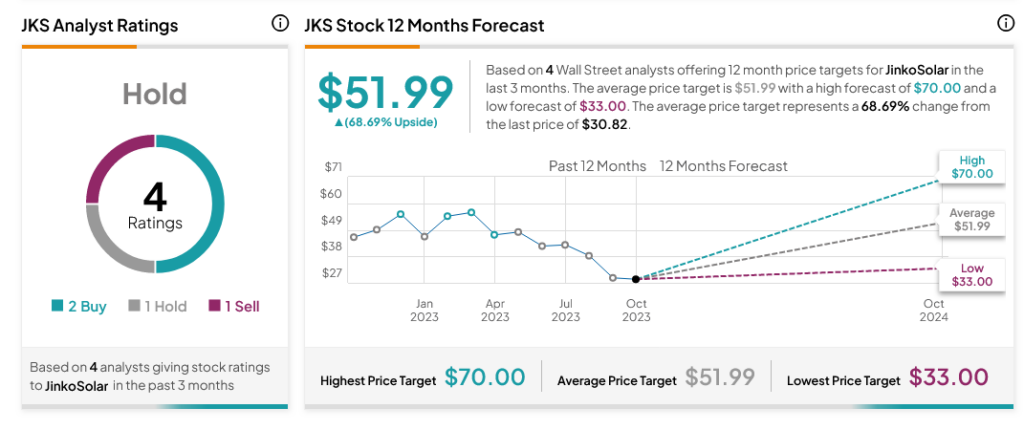

Turning to Wall Street, analysts have a Hold consensus rating on JKS stock based on two Buys, one Hold and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average JKS price target of $51.99 per share implies 68.69% upside potential.