New tariffs generally make it tougher for any business that imports or exports products or components. This will be the case for several solar stocks in the path of new tariffs from the United States government, which took hits today. However, some managed to dodge the blow. JinkoSolar (NYSE:JKS) was one of those, and it turned up slightly in Friday afternoon’s trading. Nevertheless, Canadian Solar (NASDAQ:CSIQ) and the Invesco Solar ETF (NYSEARCA:TAN) both got hit with the fallout.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The U.S. Commerce Department found that several Chinese companies—Longi Green Energy, BYD, New East Solar, Trina Solar, and Canadian Solar—were all ducking established tariffs on Chinese solar equipment brought into the U.S. The dodge took place by making the panels and the like in China, but sending them to other Southeast Asian countries—like Cambodia, Malaysia, Vietnam, and Thailand—for finishing, and from there, out to the U.S.

That led to new tariffs being established, and they’re quite heavy, too, reaching up to 254% starting in June 2024. However, JinkoSolar—as mentioned above—along with Hanwha Q Cells and Boviet Solar Technology, were all found to be not trying to duck the tariffs, and so, they’ll miss out on the vastly expanded new tariffs.

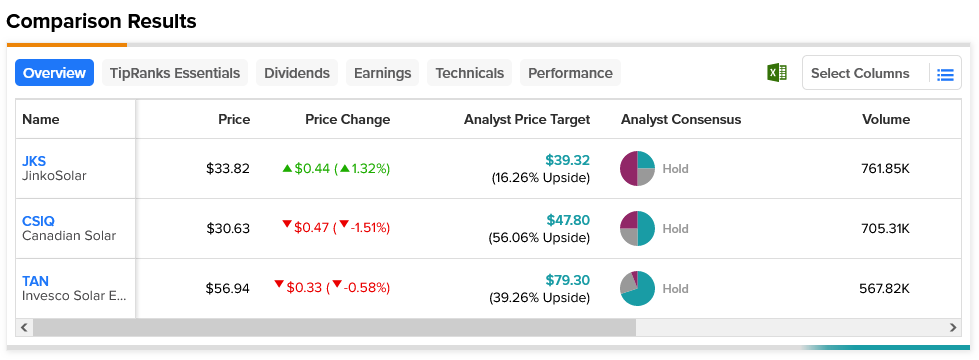

JinkoSolar may have dodged a bullet today, but when it comes to Wall Street, it’s also got the worst upside expectations. While JinkoSolar, Canadian Solar, and the Invesco Solar Energy ETF are all considered Holds by analyst consensus, each has much different upside potential. JinkoSolar, with an average price target of $39.32, has 16.26% upside potential. Canadian Solar, however, has a 56.06% upside potential on its average price target of $47.80.