Billionaire investor Ken Griffin founded and runs the most famed hedge fund Citadel LLC, since 1990. Citadel topped the asset management industry in terms of total returns generated in 2023. As of date, Citadel manages more than $60 billion in assets under management (AUM).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

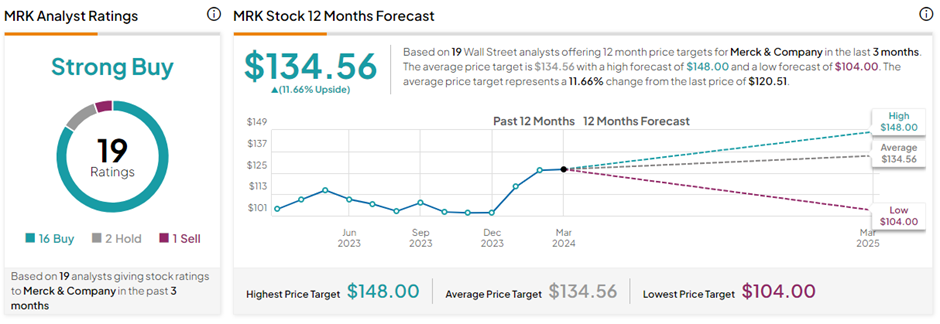

Griffin is heavily invested in technology stocks, especially those called the Magnificent Seven stocks. Importantly, a majority of hedge funds have their top-most holdings in the tech sector. Today, we will look at Citadel’s five top holdings that are not technology stocks.

#1 AT&T (NYSE:T)

AT&T is one of the leading telecommunications companies in the U.S. It is one of the biggest players in the 5G and fiber network space and boasts millions of users. T stock also boasts an attractive dividend yield of 6.45%, much higher than the sector average of 2.54%.

AT&T holds the seventh position in Citadel’s portfolio representing 0.86%. As of December 31, 2023, Citadel owned 50.77 million shares of AT&T worth $851.87 million.

For Fiscal 2024, AT&T expects its Wireless service revenue to grow by 3% and Broadband revenue to increase by over 7%. It expects to generate free cash flow in the range of $17 to $18 billion. Also, adjusted EPS is projected in the range of $2.15 to $2.25, lower than Fiscal 2023.

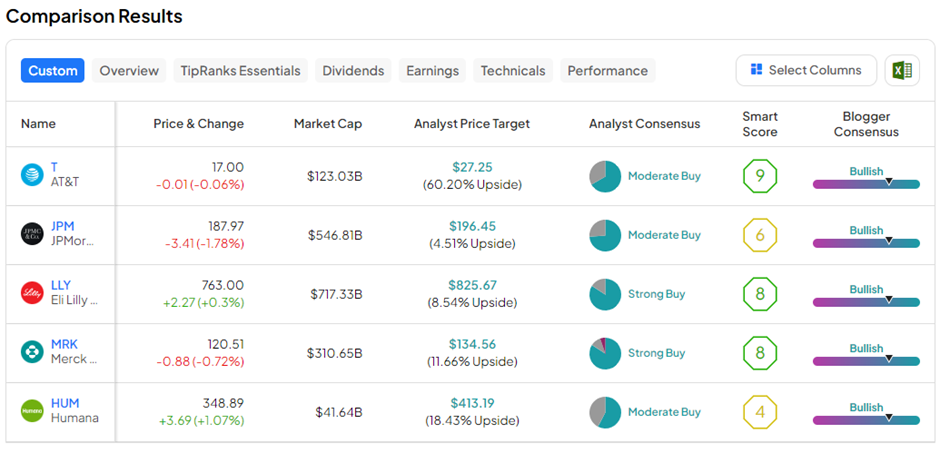

Is AT&T Stock a Buy or a Hold?

With ten Buys versus five Hold ratings, T stock has a Moderate Buy consensus rating on TipRanks. The average AT&T share price target of $27.25 implies 60% upside potential from current levels.

#2 JPMorgan Chase & Co. (NYSE:JPM)

Universal bank JPMorgan needs no introduction. A major banking institute with global operations, JPMorgan offers all services in the financial sector domain, including retail and commercial banking, wealth and asset management, and more. JPM’s quarterly dividend of $1.05 per share reflects a yield of 2.16%, in line with the sector average.

JPM is Citadel’s eighth largest bet, constituting 0.78% of the portfolio. As of 2023 end, Griffin’s hedge fund held 4.55 million shares worth $773.59 million.

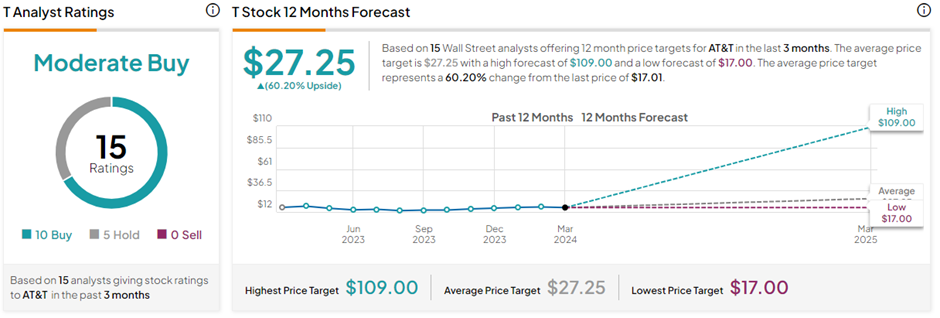

Is JPM a Good Stock to Buy?

Yesterday, Daiwa analyst Kazuya Nishimura lifted the price target on JPM to $220 (17% upside) from $200 while keeping a Buy rating. The analyst is highly optimistic about the banking sector’s growth as the investment banking market is expected to recover and credit costs could peak soon.

On TipRanks, JPM has a Moderate Buy consensus rating based on 17 Buys and six Hold ratings. The average JPMorgan & Chase Co. share price forecast of $195.45 implies nearly 4% upside potential from current levels.

#3 Eli Lilly & Co (NYSE:LLY)

Eli Lilly is a well-known American pharmaceutical company having a solid pipeline of drugs. Its current battle to become the leader in the weight loss drug category has kept investors on their toes. LLY shares have zoomed over 130% in the past year thanks to a series of successful drug trials and new drug launches.

LLY stock stands at the ninth spot in Citadel’s portfolio (0.75%). Griffin held 1.28 million shares of Eli Lilly worth $743.83 million as of December 31, 2023.

Eli Lilly has forecasted heavy demand for its diabetes and weight loss drugs this year and is ramping up production to ensure adequate supply. Meanwhile, the FDA’s (U.S. Food and Drug Administration) decision to delay the approval of LLY’s new Alzheimer’s treatment, donanemab, has put the company under pressure.

Is Eli Lilly a Buy or Sell?

LLY stock commands a Strong Buy consensus rating on TipRanks, backed by 16 Buys and three Hold ratings. The average Eli Lilly & Co. share price target of $825.67 implies 8.5% upside potential from current levels.

#4 Merck & Co (NYSE:MRK)

Merck is another healthcare stock that Griffin is very optimistic about. Merck is a multinational pharma company that develops and produces medicines, vaccines, biologic therapies, and animal health products. MRK stock also pays a lucrative dividend of $0.77 per share, reflecting a yield of 2.42%, above the sector average.

Merck is the tenth largest investment in Citadel’s portfolio (0.69%). As of December 31, 2023, Citadel owned 6.32 million shares of Merck worth $688.81 million.

For Fiscal 2024, Merck projects global sales between $62.7-$64.2 billion and adjusted earnings between $8.44-$8.59 per share.

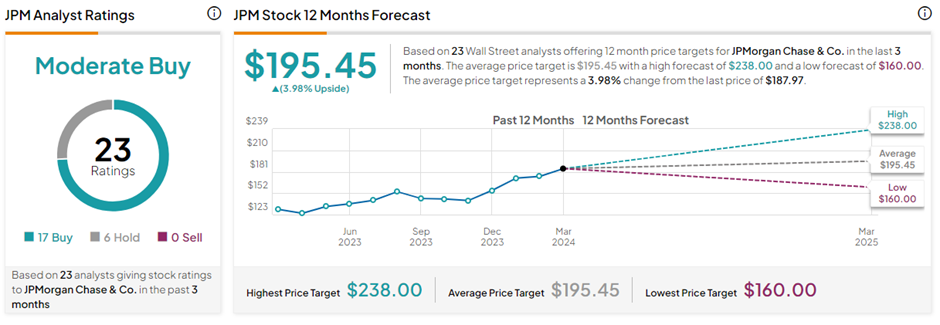

Is Merck a Good Stock to Buy?

With 16 Buys, two Holds, and one Sell rating on TipRanks, MRK stock has a Strong Buy consensus rating. The average Merck & Co. share price forecast of $134.56 implies 11.7% upside potential from current levels. In the past year, MRK stock has gained nearly 12%.

#5 Humana Inc (NYSE:HUM)

Humana is one of the largest health insurance service providers in the U.S. offering Medicare benefits and state-based Medicaid contracts. Humana’s dividend of $0.88 per share is payable on April 26, with a yield of 1.02%.

Ranked 12th on Citadel’s portfolio, the firm held 1.5 million shares of Humana worth $688.15 million as of December end.

Humana’s financial performance is challenged by increased Medicare Advantage medical costs, as inpatient utilization has increased considerably recently. This has led to diminishing profit margins.

For Fiscal 2024, Humana has guided for adjusted earnings of $16 per share, much lower than FY23’s figure of $26.09 per share. This is because the company expects higher medical costs to persist this year.

Is Humana a Good Stock to Buy Now?

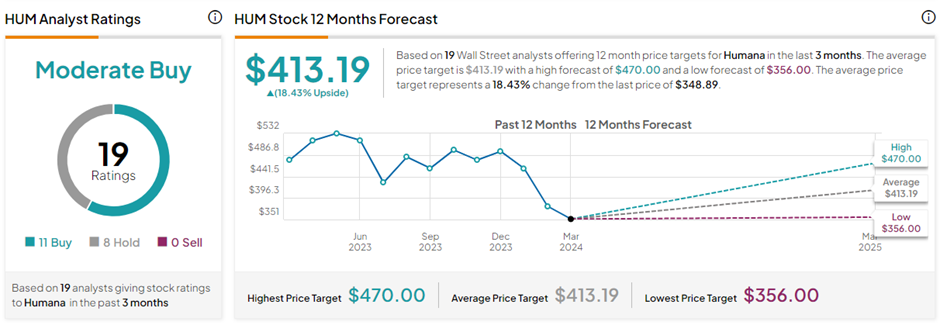

On March 13, Argus analyst David Toung downgraded HUM stock to Hold from Buy due to the challenges mentioned above. Overall, with 11 Buys versus eight Holds, HUM stock has a Moderate Buy consensus rating. On TipRanks, the average Humana share price target of $413.19 implies 18.4% upside potential from current levels.

Key Takeaways

Ken Griffin has a record of generating high returns for clients based on his stock-picking prowess. Investors can refer to his stock picks to understand which stocks could be the probable winners in the long run.