Investors seeking a balance between growth potential and risk often turn to mid-cap stocks, which represent companies with market capitalizations between $2 billion and $10 billion. Additionally, these stocks have the potential to provide significant returns as they are in the phase of expanding their market share.

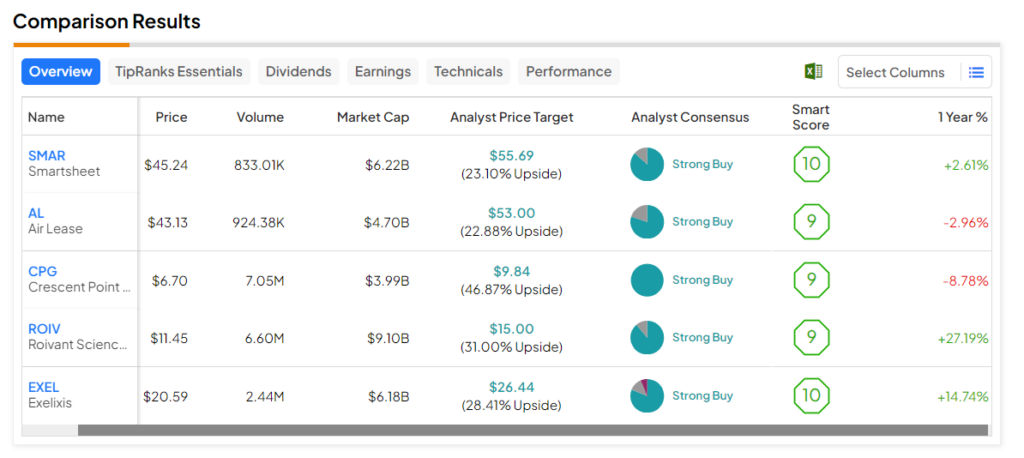

With the help of TipRanks’ Stock Screener tool, we have shortlisted five mid-cap stocks. These stocks have received a Strong Buy rating from analysts and boast an Outperform Smart Score (i.e., 8, 9, or 10) on TipRanks, which points to their potential to beat the broader market. Further, analysts’ price targets reflect an upside potential of more than 20%.

Here are five top mid-cap stocks for investors to consider.

- Roivant Sciences (NASDAQ:ROIV) – The biopharmaceutical company helps accelerate the development of innovative therapies with its technology platforms. The stock has an analyst consensus upside of 31% and a Smart Score of nine.

- Exelixis (NASDAQ:EXEL) – Exelixis is a biopharmaceutical company focused on improving cancer treatment. EXEL stock’s price forecast of $26.44 implies a 28.4% upside. The stock earns a Smart Score of “Perfect 10.”

- Smartsheet (NYSE:SMAR) – Smartsheet is a software platform that helps organizations work more efficiently and effectively. Its price forecast of $55.69 implies a 23.1% upside. Also, the stock has a Smart Score of eight.

- Air Lease (NYSE:AL) – Air Lease is a leading aircraft leasing company, providing aircraft fleet solutions to airlines worldwide. The stock’s average price target implies a consensus upside of 22.9% and carries a Smart Score of nine.

- Crescent Point Energy (NYSE:CPG) – This company engages in the exploration, development, and production of oil and gas properties. The stock’s average price target of $9.84 implies a 46.9% upside potential. Also, its Smart Score of nine is encouraging.