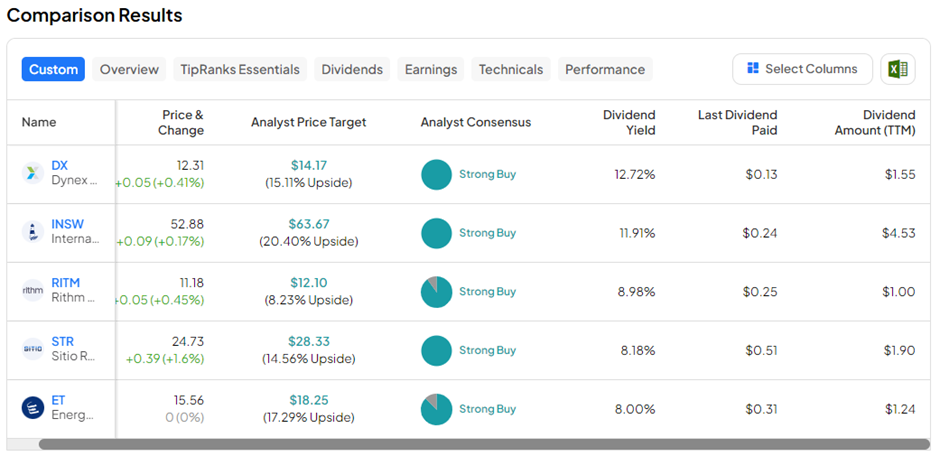

Today, we will look at the 5 Best Dividend Stocks that investors could consider buying in March 2024 and which are also loved by analysts. These five stocks carry high dividend yields and have also scored a Strong Buy analysts consensus rating on TipRanks. Further, each could offer a reasonable share price appreciation potential in the next twelve months, as per analysts.

Investors often seek to balance their diversified portfolios by including dividend stocks in them. These stocks pay regular dividends out of their earnings to reward shareholders. Let’s look at the five stocks below and see how they compensate investors.

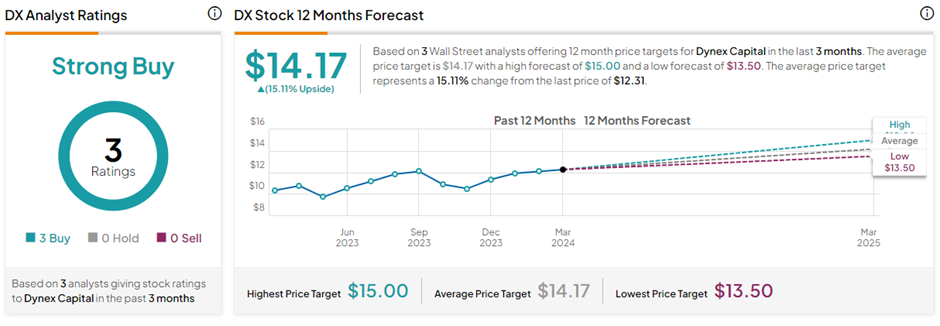

#1 Dynex Capital Inc. (NYSE:DX)

Dynex Capital operates as an internally managed mortgage real estate investment trust (REIT). Its primary business is to invest in agency and non-agency residential and commercial mortgage-backed securities (MBS) on a leveraged basis. The company is committed to investing shareholders’ money with expert risk management practices, disciplined capital allocation, and social responsibility. In doing so, Dynex Capital generates dividend income and long-term total returns for its shareholders.

Dynex pays a regular monthly dividend of $0.13 per share, with the upcoming dividend payable on April 1, 2024. This represents a robust dividend yield of 12.72%, significantly higher than the sector average.

For Fiscal 2023, Dynex paid total dividends of $1.56 per share, including a Q4 dividend of $0.39 per share. In Q4 FY23, DX reported a comprehensive income of $1.44 per share with net income of $0.39 per share.

Is Dynex a Good Stock to Buy?

With three unanimous Buy ratings, DX has a Strong Buy consensus rating on TipRanks. The average Dynex Capital price target of $14.17 implies 15.1% upside potential from current levels. In the past year, DX stock has gained 4.3%.

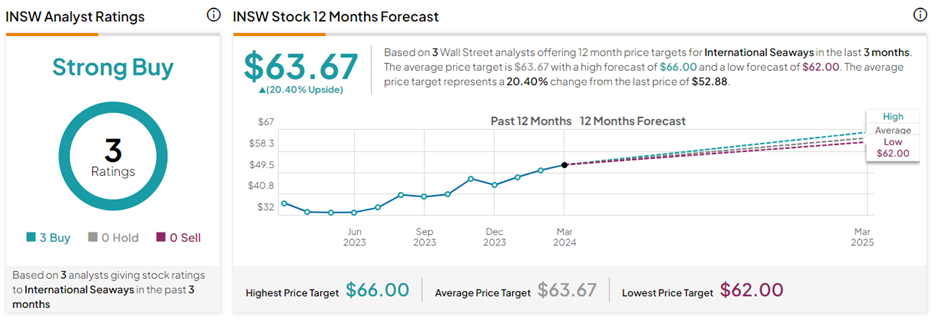

#2 International Seaways, Inc. (NYSE:INSW)

New York-based International Seaways is one of the world’s largest tanker companies, transporting crude oil and refined petroleum products worldwide. INSW provides shipping services to customers through voyage charters, commercial pools, and time charters.

INSW also boasts a handsome dividend yield of 11.81%. For Q4 FY23, the company declared a dividend of $1.32 per share, including a supplemental dividend of $1.20 per share and a regular dividend of $0.12 per share to be paid on March 28.

Coming to recent results, INSW reported fourth-quarter adjusted earnings of $2.18 per share on shipping revenues of $250.73 million, reflecting declining performance compared to the prior-year period.

What is the Stock Price Forecast for INSW?

The average International Seaways price forecast of $63.67 implies 20.4% upside potential from current levels. Also, INSW has a Strong Buy consensus rating based on three unanimous Buys on TipRanks. INSW shares have gained 23.2% in the past year.

#3 Rithm Capital (NYSE:RITM)

Rithm is an asset management company focused on real estate and financial services. The company seeks to enhance the long-term value of its portfolio while maintaining a rigorous risk management approach.

Rithm pays a quarterly dividend of $0.25 per share, with the last one paid on January 26, 2024. The stock offers an attractive yield of 9.21%.

In Q4 FY23, RITM posted better-than-expected adjusted earnings of $0.51 per share on revenues of $709.47 million.

Is Rithm Capital a Good Stock to Buy?

On March 11, UBS analyst Doug Harter lifted the price target for RITM stock to $13 from $12.50 while keeping a Buy rating. Harter is encouraged by Rithm’s attractive valuation and high dividend yield.

Overall, with nine Buys and one Hold recommendation, RITM stock has a Strong Buy consensus rating on TipRanks. The average Rithm Capital price forecast of $12.10 implies 8.2% upside potential from current levels. RITM shares have gained 41.9% in the past year.

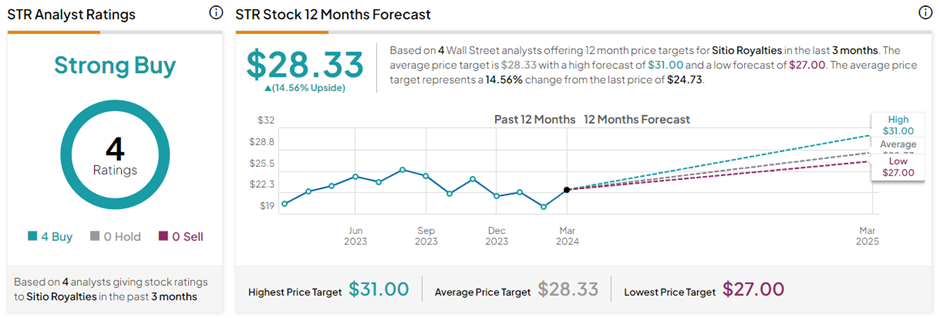

#4 Sitio Royalties (NYSE:STR)

Colorado-based Sitio Royalties acquires high-quality oil and gas mineral and royalty interests in productive U.S. basins. The company leases its assets to exploration and production (E&P) entities in the oil and gas sector and, in return, earns a portion of the proceeds generated from the sale of commodities extracted from these assets. Sitio has over 252,000 Net Royalty Acres (NRAs) of assets as of date.

STR’s latest quarterly dividend of $0.51 per share is payable on March 28 and marks a 4% increase compared to the Q3 FY23 dividend. The company has a high dividend yield of 8.54%.

For Fiscal 2023, STR earned revenues of $593.36 million, up 60.5% year-over-year. At the same time, it reported a net loss of $0.20 per share owing to higher operating expenses, including depreciation, depletion, amortization expense, impairment charges, and loss on the sale of oil and gas properties. Furthermore, the company has signed a definitive agreement to acquire 13,062 NRAs in the DJ Basin, with the deal expected to close in Q2 FY24.

Is Sitio Royalties a Buy or Sell?

With four unanimous Buys, STR stock has a Strong Buy consensus rating. The average Sitio Royalties price target of $28.33 implies 14.6% upside potential from current levels. STR stock has gained 13.4% in the past year.

#5 Energy Transfer LP (NYSE:ET)

Energy Transfer LP is one of North America’s largest and most diversified midstream energy companies. It transports, and stores natural gas, crude oil, NGLs, refined products, and liquid natural gas (LNG). On November 3, 2023, ET completed its merger with Crestwood Equity Partners LP, extending its value chain deeper into the Williston and Delaware basins and entering the Powder River basin.

ET pays a regular quarterly dividend of $0.315 per share, reflecting a yield of 8% and up 3.3% compared to the prior-year period. In Q4 FY23, ET reported diluted earnings of $0.37 per share on revenues of $20.53 million, mostly in line with prior-year figures.

What is the Future of ET Stock?

With seven Buys versus one Hold recommendation, ET stock commands a Strong Buy consensus rating on TipRanks. The average Energy Transfer LP price target of $18.25 implies 17.3% upside potential from current levels. Meanwhile, ET stock has gained 31.4% in the past year.

Ending Thoughts

The above five dividend stocks can add value to an investor’s portfolio, thanks to the regular income stream that they provide. Moreover, most of these companies have sound financial backing and high growth prospects, which would enable them to continue paying dividends in the long run and earn analysts’ bullish ratings.