In the ongoing Artificial Intelligence (AI) wave, one can benefit from investing in AI stocks that offer high upside potential, according to analysts. Companies are investing heavily in machine learning, large language models (LLMs), AI-based applications and tech, digital chatbots as well as automation and robotics, thus driving the upside in AI stocks.

Analysts focused on the technology sector have the expertise to identify AI stocks that can outperform the broader markets. Their analysis is backed by solid research and fundamental analysis of each stock.

With this background in mind, let us look at 5 AI stocks that offer the highest upside potential, according to analysts on TipRanks.

#1 Alphabet Class A (NASDAQ:GOOGL)

Since the onset of the ChatGPT boom, Alphabet has been one of the fastest tech companies to launch its own generative AI Bard chatbot (now called Gemini). Alphabet’s services, such as Google and YouTube, use AI and automation for aspects like ad pricing and promotion, Gmail spam filters, etc. Google is betting big on using AI to improve its Search engine results as noted by CEO Sundar Pichai in the Q4 FY23 earnings call.

Moreover, Google is pushing for the direct integration of its compressed Gemini Nano model into smartphones. Meanwhile, the search engine giant had to temporarily shut down its Gemini AI program after it gave some bizarre racial images.

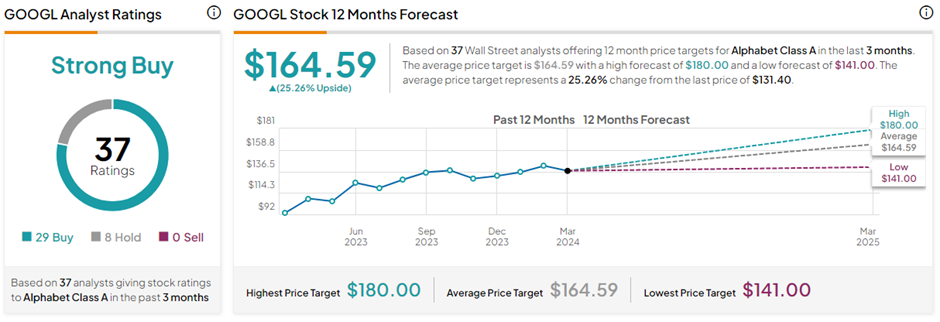

With Alphabet’s AI use case in mind, analysts have a Strong Buy consensus rating on GOOGL stock. This is backed by 29 Buys versus eight Hold ratings on TipRanks. The average Alphabet Class A share price target of $164.59 implies 25.3% upside potential from current levels.

#2 Amazon.com (NASDAQ:AMZN)

E-commerce giant Amazon.com has since ages used AI to improve its search results and recommend products on its online portal. Plus, it uses automation and robotics at its Amazon fulfillment centers.

The tech giant’s Amazon Web Services (AWS) unit has huge potential to grow its infrastructure and applications in the cloud segment with offerings such as virtual assistants, productivity tools, and search. Furthermore, Amazon’s recent $4 billion investment in AI start-up Anthropic bodes well for its cloud computing services.

With 41 unanimous Buy ratings on TipRanks, AMZN stock has a Strong Buy consensus rating. The average Amazon.com share price forecast of $208.48 implies 20.2% upside potential from current levels.

#3 Apple (NASDAQ:AAPL)

Apple has been one of the last Big tech players in the race to come up with its own generative AI products. Even so, the company has slowly started integrating AI into its products, enabling customers to use intelligent features such as powerful cameras, speech-to-text conversion and translation, text predictions, accessibility features, and so on.

Apple has had a bit of a sour year so far, with the stock down 12%. Analysts remain split on Apple’s stock trajectory until the iPhone maker shows its true potential in the AI space.

With 16 Buys, nine Holds, and one Sell rating, AAPL stock has a Moderate Buy consensus rating on TipRanks. The average Apple Inc. share price target of $205.07 implies 21.3% upside potential from current levels.

#4 Microsoft (NASDAQ:MSFT)

Microsoft was the first tech company to significantly invest in the generative AI space with OpenAI. Microsoft has integrated ChatGPT into its Bing search engine and is on track to integrate the model in other products, including Azure cloud infrastructure, the Edge browser, Microsoft Office Suite, and the CoPilot for Microsoft 365.

On TipRanks, MSFT stock commands a Strong Buy consensus rating based on 31 Buys, one Hold, and one Sell rating. The average Microsoft Inc. share price target of $468.70 implies 16.6% upside potential from current levels.

#5 Meta Platforms (NASDAQ:META)

Meta introduced its large language models Llama 1 and 2 in the early stages of the AI frenzy and is on track to launch its Llama 3 large language model in July this year. Meta is working on augmenting the model to “deal with contentious questions” to avoid issues faced by Google. The social media platform is also building an AI supercomputer and plans to build custom AI chips for its data center customers.

META stock also has a Strong Buy consensus rating on TipRanks, backed by 40 Buys, two Holds, and one Sell rating. The average Meta Platforms share price target of $528.80 implies 6.6% upside potential from current levels.

Ending Thoughts

The above five companies have the best upside potential based on the consensus price targets of Wall Street analysts. Investors can consider the addition of these AI stocks to their portfolios to gain exposure to the exploding AI world.