Exchange-traded funds (ETFs) remain a key channel for investors seeking strong returns. However, deciding which to buy can be a Herculean task. That’s where our ETF AI analysts come in!

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

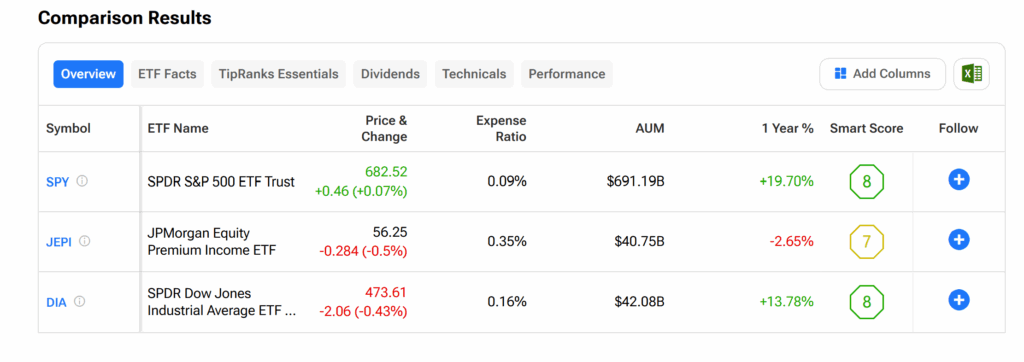

Below are the top three ETFs that TipRanks’ AI analysts think you should bank on. These ETFs all currently have an Outperform rating and offer at least 10% upside. The chart below also shows how the three funds compare.

SPDR S&P 500 ETF Trust (SPY) — This popular ETF tracks the S&P 500 Index. The index itself measures the market performance of the 500 largest companies in the U.S., spanning industries such as technology, healthcare, and financials. SPY is currently managed by SPDR, which is the ETF brand of State Street Global Advisors (STT).

The ETF AI analyst currently has a price target of $755 on SPY, suggesting approximately 11% upside. The fund’s current Outperform rating is based on solid performance from the stocks that receive the fund’s largest financial allocations and have risen significantly since the start of the year, thereby helping to elevate overall returns. Examples are chip designers Nvidia (NVDA) and Broadcom (AVGO).

JPMorgan Equity Premium Income ETF (JEPI) – This ETF invests in several well-established U.S. companies across various industries. The fund aims to deliver both growth opportunities and steady monthly payouts by investing in top-tier stocks and taking advantage of shifting market conditions. The fund is owned and operated by JPMorgan Chase (JPM), the largest U.S. commercial bank.

The ETF AI analyst currently has a price target of $64 on JEPI, implying about 14% upside. The fund’s current Outperform rating is fueled by robust gains since the start of the year from its top holdings, which include tech leaders like Nvidia and Alphabet (GOOGL).

The SPDR Dow Jones Industrial Average ETF Trust (DIA) — This is another ETF owned and managed by SPDR. The fund tracks the Dow Jones Industrial Average, a well-known stock market index composed of 30 major U.S. companies.

The ETF AI analyst currently has a price target of $520 on DIA, suggesting approximately 10% upside. The fund’s current Outperform rating is supported by strong year-to-date gains in the stocks with the largest holdings. This group includes major companies such as the banking powerhouse Goldman Sachs (GS) and the construction and mining equipment manufacturer Caterpillar (CAT).