These are the 3 Best Dividend stocks to buy in April 2024, as per Wall Street analysts. Investing in dividend stocks is one of the best ways to earn passive income. For investors who need a regular stream of money to meet their financial needs, dividend stocks can be an apt choice. Plus, dividend stocks offer a great way to diversify your portfolio, given their low risk and high reward profile.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

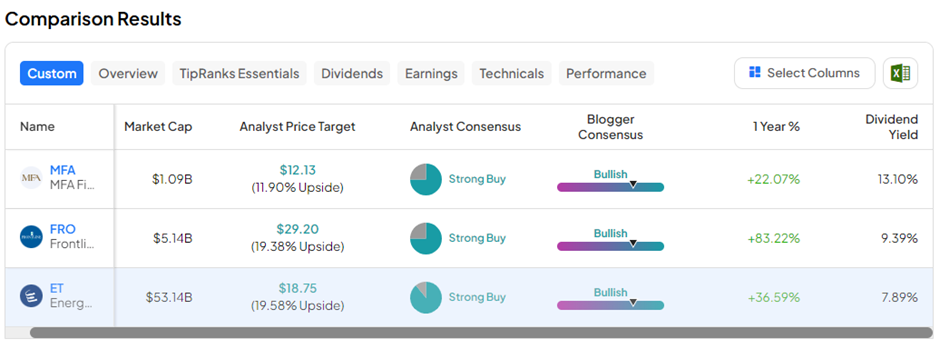

To help investors benefit from investing in dividend-paying companies, we sorted three stocks that offer above-average dividend yields and are also favored by analysts. Moreover, the average price target of these stocks indicates at least a 10% share price appreciation potential in the next twelve months.

#1 MFA Financial, Inc. (NYSE:MFA)

MFA Financial is a real estate investment trust (REIT) engaged in the business of investing, on a leveraged basis, in residential mortgage assets, including residential mortgage-backed securities and residential whole loans. As a REIT status company, it is mandatory for MFA to pay 90% of its taxable income as dividends to shareholders.

MFA Financial pays a regular quarterly dividend of $0.35 per share, reflecting a solid yield of 12.27%. Its most recent dividend is payable on April 30, 2024.

In Fiscal 2023, the company’s net interest income after provision for credit losses fell 6.2% owing to the highly volatile interest rate environment. Meanwhile, earnings per share (EPS) improved to $0.46 from a massive net loss of $2.57 per share in FY22. The company delivered a total stockholder return of 30.7% in the full year.

Is MFA Financial a Good Stock to Buy?

With three Buys versus one Hold rating, MFA stock has a Strong Buy consensus rating on TipRanks. The average MFA Financial price target of $12.13 implies 11.9% upside potential from current levels. In the past year, MFA shares have gained 7.3%.

#2 Frontline Plc (NYSE:FRO)

Cyprus-based Frontline Plc operates the world’s fourth-largest oil tanker shipping company. It transports crude oil and refined products globally via its massive and modern fleet of 76 tankers, including VLCCs, Suezmax, and LR2/Aframax. The sea transporter constantly refurbishes its fleet with newer vessels and discards older ones, thus maintaining high transportation efficiency.

Frontline’s dividend policy is unique, as the company aims to distribute quarterly dividends equal to or close to the adjusted EPS. Consequently, the dividend per share amount fluctuates.

Frontline’s most recent dividend of $0.37 per share was paid on March 27. It reflected a high dividend yield of 9.07%.

In Fiscal 2023, total revenues and operating income rose 27%, while adjusted EPS jumped 65.4% to $2.63. Accordingly, Frontline paid total dividends of $2.17 per share in Fiscal 2023.

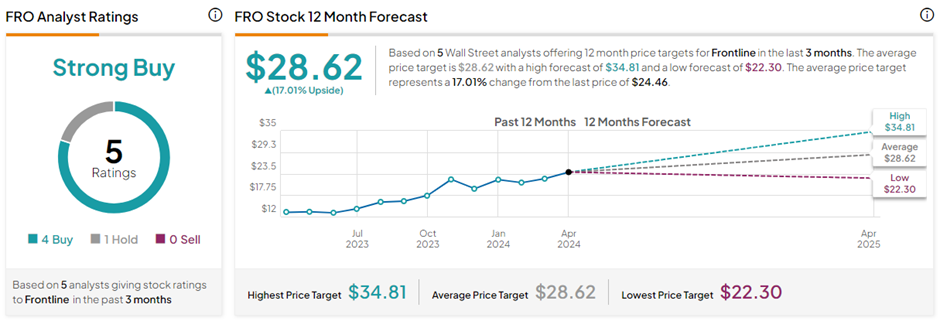

What is the Price Target for Frontline Stock?

The average Frontline price target of $28.62 implies 17% upside potential from current levels. On TipRanks, FRO stock has a Strong Buy consensus rating, backed by four Buys and one Hold rating. At the same time, FRO shares have gained 61.5% in the past year.

#3 Energy Transfer LP (NYSE:ET)

Texas-based Energy Transfer is one of the largest players in the midstream energy segment. The company transports, and stores natural gas, crude oil, NGLs, refined products, and liquefied natural gas (LNG). On November 3, 2023, ET completed its merger with Crestwood Equity Partners LP (CEQP), extending its value chain deeper into the Williston and Delaware basins and entering the Powder River basin.

Energy Transfer paid its most recent dividend of $0.315 per share on February 20, 2024. The dividend reflects a lucrative yield of 7.92%. For the full year 2023, ET paid total dividends of $1.245 per share, up from the $1.00 per share paid in 2022.

Coming to financial performance, ET’s revenues fell 12.6% in FY23, while EPS declined to $1.09 per share from $1.40 reported in the previous year.

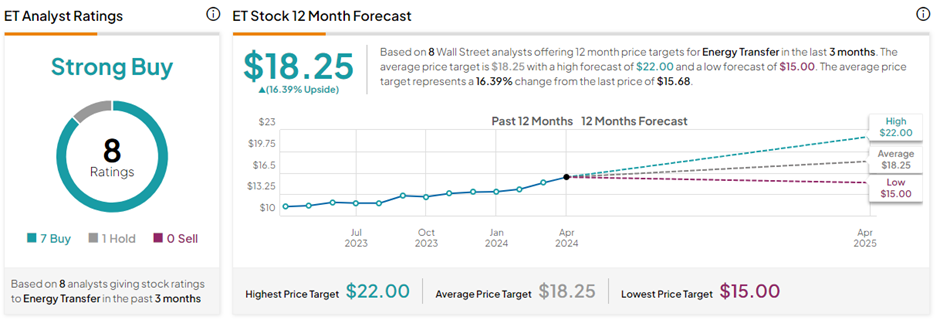

Is ET Stock a Good Buy?

With seven Buys versus one Hold recommendation, ET stock has a Strong Buy consensus rating on TipRanks. The average Energy Transfer price target of $18.25 implies 16.4% upside potential from current levels. In the past year, ET shares have gained 24.3%.

Ending Thoughts

Investors can consider the aforementioned 3 dividend stocks to realize higher returns on their portfolios. These three companies pay healthy dividends, have earned a Strong Buy consensus rating from analysts, and could offer reasonable share price appreciation potential in the next twelve months.