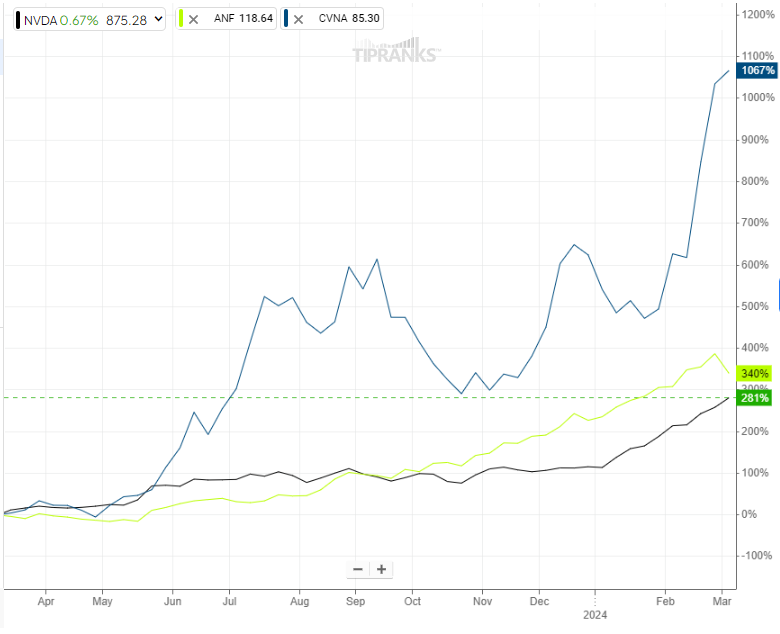

The blistering rally in shares of chip giant Nvidia (NASDAQ:NVDA) has sustained in 2024, driving its market cap ahead of Amazon (NASDAQ:AMZN) and Alphabet (NASDAQ:GOOGL). Thanks to the upward trend, NVDA stock could soon overtake iPhone maker Apple (NASDAQ:AAPL). Despite Nvidia experiencing significant gains, consumer stocks like Carvana (NYSE:CVNA) and Abercrombie & Fitch (NYSE:ANF) have crushed NVDA with their impressive gains.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Nvidia stock is up about 281% in one year. During the same period, shares of Carvana, a digital platform to buy and sell used cars, have gained over 1,040% in one year. Further, shares of specialty apparel and accessories retailer Abercrombie & Fitch are up about 340%.

While CVNA and ANF stocks have delivered stellar returns over the past year and outperformed NVDA, let’s look at the Street forecast for these consumer stocks.

Is Carvana a Good Stock to Buy Today?

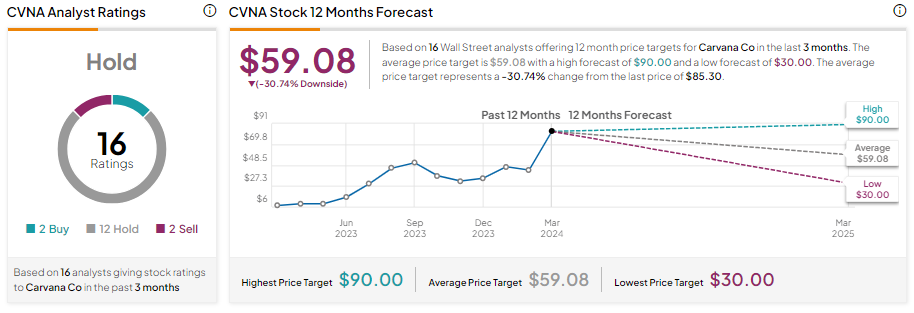

The rally in Carvana stock is fuelled by the company’s focus on improving its gross profit per unit (GPU), lowering inventory turnover times, and growing revenues from additional services. Thanks to its efforts, the company delivered positive adjusted EBITDA in Q4 and significantly reduced losses.

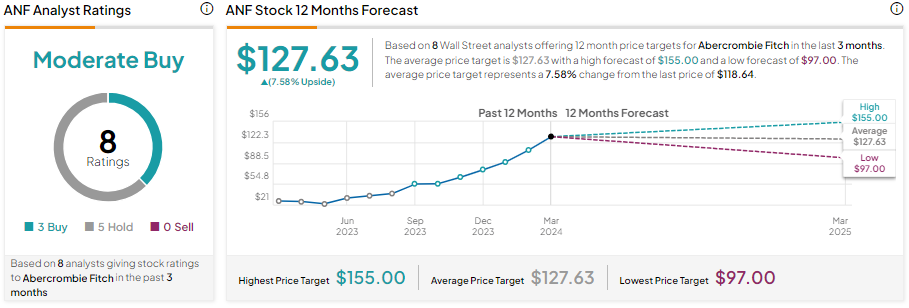

Further, CVNA’s management expects the retail units sold and adjusted EBITDA to improve in 2024, which is positive. However, due to the notable rally in its shares, analysts remain sidelined. With two Buy, 12 Hold, and two Sell recommendations, CVNA stock has a Hold consensus rating. Analysts’ average price target on CVNA stock is $59.08, implying 30.74% downside potential from current levels.

What is the Forecast for ANF?

Abercrombie & Fitch stock benefitted from the company’s transformation initiatives aimed at accelerating sales, reducing expenses, and improving profitability. The company’s tight control over costs will likely drive earnings.

ANF stock has three Buy and five Hold recommendations for a Moderate Buy consensus rating. However, due to the significant increase in its value, analysts’ average price target on ANF stock is $127.63, implying a limited upside potential of 7.58% from current levels.