Carvana (NYSE:CVNA) stock jumped nearly 24% in Thursday’s after-hours trading after the company delivered strong gross profit per unit (GPU) in Q4, positive adjusted EBITDA, and significantly reduced losses. However, the company’s top and bottom lines came below analysts’ expectations.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company reported an adjusted GPU of $5,730, up from $2,667 in the prior year quarter. The company’s focus on improving retail non-vehicle cost of sales, reducing inventory turn times, and growing revenues from additional services continues to drive its GPU.

The company is an online platform for buying and selling used cars.

CVNA Misses Analysts’ Estimates

Carvana delivered total revenue of $2.424 billion, down 15% year-over-year. Retail units sold fell 13%. Further, Carvana’s total revenue came in lower than the analysts’ estimate of 2.56 billion.

Despite lower sales, the company’s focus on cutting costs and achieving profitability led to a significant improvement in its adjusted EBITDA. CVNA delivered adjusted EBITDA of $60 million in Q4 compared to a loss of $291 million in the prior-year quarter.

Further, its net loss of $1 per share compared favorably to the loss of $7.61 in Q4 of 2022. However, it came slightly higher than the Street’s loss forecast of $0.85 per share.

Upbeat Outlook

The company’s management offered an upbeat outlook. CVNA’s leadership expects the retail units sold to improve year-over-year. Further, the company projects adjusted EBITDA to be above $100 million.

As for 2024, the company expects its retail units sold and adjusted EBITDA to improve year-over-year.

Is CVNA a Good Stock to Buy?

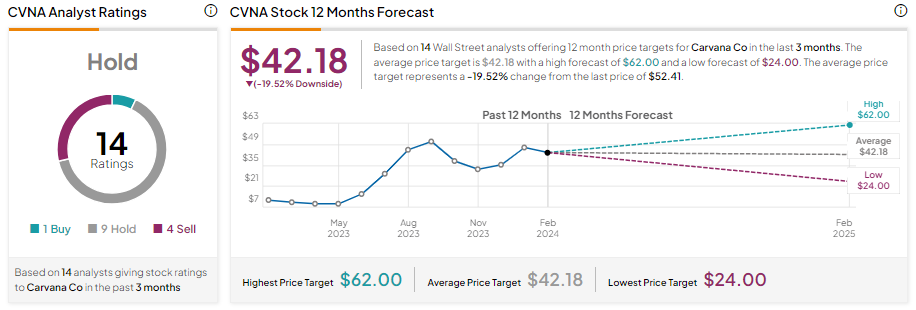

CVNA stock is up about 420% in one year. Given the significant rally in its share price, analysts remain sidelined. With one Buy, nine Hold, and four Sell recommendations, CVNA stock has a Hold consensus rating.

Analysts’ average price target of $42.18 implies 19.52% downside potential from current levels.