A number of banking companies have agreed to pay penalties of $1.1 billion for allegations of wrongdoing or misconduct, and for failure to monitor their employees’ communications and use of unauthorized messaging apps.

According to a filing by the Securities and Exchange Commission (SEC), the mentioned banks failed to safeguard electronic communications, especially over WhatsApp.

The filing stated that the banks’ employees communicated regarding business matters using text messaging apps on their personal devices between January 2018 through September 2021.

The banks acknowledged that their actions violated rules of recordkeeping under federal securities laws. They gave assurance that they would make improvements to their compliance policies and procedures going forward.

According to the WSJ, eight banks, including Goldman Sachs Group (NYSE:GS) and Morgan Stanley (NYSE:MS), will pay a sum of $125 million each to the SEC and a minimum of $75 million to the Commodity Futures Trading Commission (CFTC). Nomura will pay $100 million, while Jefferies (NYSE:JEF) will pay a total fine of $80 million, with Cantor Fitzgerald & Co. paying $16 million.

What is GS Price Target?

On TipRanks, Goldman Sachs Group stock’s average price target is $392.75, which implies 34.79% upside potential from current levels. Overall, the GS stock has a Moderate Buy consensus rating based on 14 Buys, four Holds and one Sell.

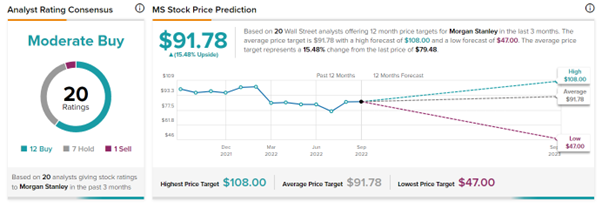

Is Morgan Stanley Stock a Buy?

As per TipRanks, analysts are cautiously optimistic about the MS stock and have a Moderate Buy consensus rating, which is based on 12 Buys, seven Holds and one Sell. Morgan Stanley stock’s average price forecast of $91.78 implies 15.48% upside potential.

Read full Disclosure