Travel demand remains solid despite macro challenges and geopolitical tensions, helping airlines recover from the pandemic-led crisis. Airlines that are focused on enhancing travel experience, streamlining operations, and reducing the debt accumulated due to the COVID-led disruption are expected to perform well over the long term. Using TipRanks’ Stock Comparison Tool, we placed Delta Air Lines (NYSE:DAL), United Airlines (NASDAQ:UAL), and Southwest Airlines (NYSE:LUV) against each other to find the airline stock that could deliver the higher returns.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Delta Air Lines (NYSE:DAL)

Delta Air Lines impressed investors with stellar first-quarter results and robust guidance for the second quarter. The company’s operating revenue increased 6% to $12.6 billion, while earnings per share (EPS) jumped 80% to $0.45. Strong travel trends and the company’s efficiency measures drove the Q1 performance.

It is worth noting that Delta generated free cash flow of $1.4 billion, even after reinvesting $1.1 billion in the business. Also, the company repaid nearly $1 billion of debt in the first quarter and expects to repay at least $4 billion of debt in 2024 as part of its efforts to bolster its balance sheet. Delta and other airlines accumulated massive debt when the pandemic-induced travel restrictions drastically hit the industry.

Delta Air Lines remains confident about achieving its full-year EPS target range of $6 to $7 and free cash flow outlook of $3 to $4 billion.

Is Delta Air Lines a Good Stock to Buy?

On May 13, HSBC analyst Achal Kumar initiated coverage of Delta Air Lines stock with a Buy rating and a price target of $72.80. The analyst called DAL his preferred play among U.S. airlines, citing its strong network mix and competitive positioning at all of its key hubs. Kumar thinks that the airline’s focus on the premium segment will drive healthy operating margins.

Kumar highlighted that while Delta is the only airline with non-unionized labor, it still pays its employees quite well and shares its profits. This ensures good employee relationships and significantly lowers the risk of strikes.

Finally, Kumar noted that the company has a solid balance sheet, with a net debt/EBITDA ratio of only 2.7x, a strong free cash flow yield, and healthy profit margins.

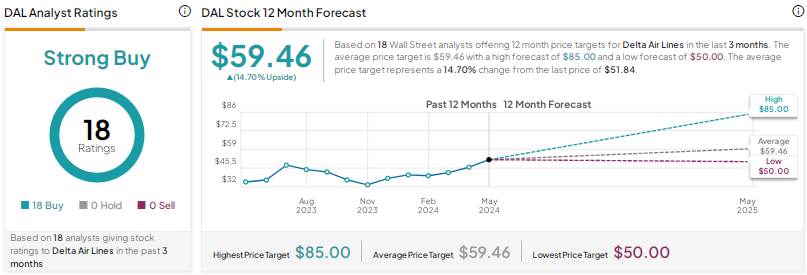

Overall, with 18 unanimous Buys, Delta scores Wall Street’s Strong Buy consensus rating on TipRanks. The average DAL stock price target of $59.46 implies nearly 15% upside potential. Shares have risen about 29% so far in 2023.

United Airlines (NASDAQ:UAL)

United Airlines shares rallied after the company crushed analysts’ first-quarter estimates. The company reported a loss per share of $0.15, much lower than the loss of $0.54 per share projected by analysts. Revenue rose nearly 10% to $12.5 billion, thanks to robust travel demand and higher capacity.

The company impressed investors by maintaining its full-year earnings outlook despite the delay in aircraft deliveries by Boeing (NYSE:BA). UAL continues to project full-year 2024 adjusted EPS in the range of $9 to $11. It expects to receive just 61 narrow-body planes this year compared to the prior estimate of 101.

Coming to Q2, UAL sees continued strength in the U.S. and Atlantic, but pressure on its business in the Pacific and Latin America regions.

Is UAL a Good Investment?

On May 17, Wolfe Research analyst Scott Group upgraded United Continental stock from Hold to Buy with a price target of $76. The analyst believes that while UAL stock has rallied strongly year-to-date, he sees more room to run due to strong fundamentals, supported by international business, premium cabin offering, and the company’s loyalty program.

The analyst expects domestic main cabin trends to improve in the second half of the year, as capacity growth finally moderates in line with GDP. At a P/E (price-to-earnings) multiple of 6x, Group finds UAL’s valuation compelling and sees huge upside potential over the next 6-12 months.

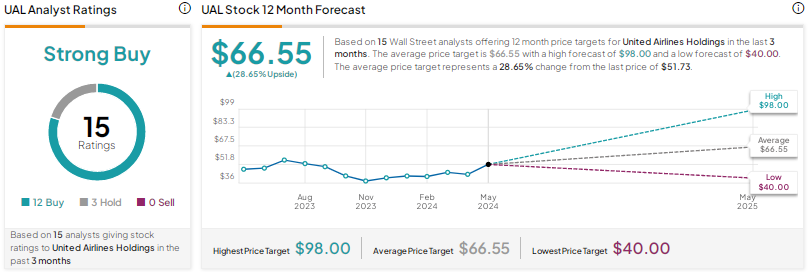

With 12 Buys and three Holds, United Airlines stock scores a Strong Buy consensus rating. At $66.55, the average price target implies 28.7% upside potential. Shares have advanced more than 25% year-to-date.

Southwest Airlines (NYSE:LUV)

Southwest Airlines is under pressure as it operates an all-Boeing 737 fleet and is severely impacted by Boeing’s aircraft delays due to quality and safety issues. The carrier expects to receive 20 Boeing 737 Max 8 planes compared to its prior projection of 46 aircraft. Southwest cautioned investors that it expects to face significant challenges this year and in 2025 due to delivery delays.

For Q1 2024, Southwest reported a loss per share of $0.36, which was higher than the Street’s estimate of a loss per share of $0.32. The weakness in Southwest’s financials is expected to persist in the quarters ahead. While the airline continues to re-optimize schedules for the second half of the year, it currently expects aircraft seats and trip frequency to fall year-over-year in Q3 and Q4 2024.

Is Southwest Stock a Buy or Hold?

On May 13, HSBC’s Achal Kumar initiated coverage of Southwest Airlines stock with a Hold rating and a price target of $27.80. The analyst thinks that the airline’s high dependency on Boeing Max aircraft could limit capacity growth, adding pressure to costs on unfavorable earnings momentum.

Kumar added that while Southwest’s competitive positioning is healthy, it might struggle to improve operating margins.

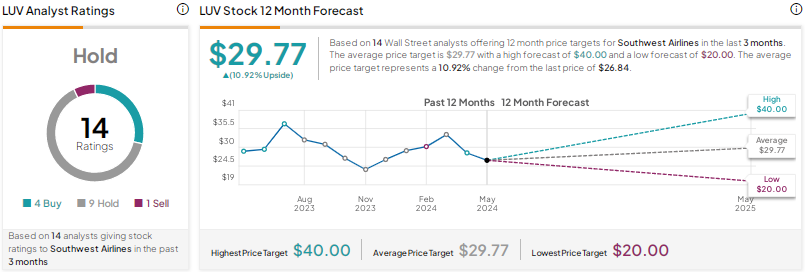

Wall Street has a Hold consensus rating on Southwest Airlines stock based on four Buys, nine Holds, and one Sell recommendation. The average LUV stock price target of $29.77 implies nearly 11% upside potential. Shares have declined 7% year-to-date.

Conclusion

Wall Street is highly bullish on Delta and United Airlines but remains sidelined on Southwest. They see higher upside potential in United Airlines compared to the other two airline stocks. As per TipRanks’ Smart Score System, UAL stock earns a “Perfect 10,” indicating that it could outperform the broader market over the long run.