Delta Airlines (NYSE:DAL) jumped in pre-market trading after announcing record revenues in the first quarter. The airline generated record operating revenues of $13.7 billion in Q1, up by 8% year-over-year and well above Street estimates of $12.5 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The revenue growth was spurred by strong travel demand, especially corporate travel sales, which increased by 14% year-over-year.

DAL reported adjusted earnings of $0.45 per share, marking an 80% year-over-year increase and surpassing consensus estimates of $0.35 per share.

Moreover, the company repaid $1 billion of debt in the first quarter and at the end of Q1, its leverage ratio was 2.9 times (2.9x). The leverage ratio measures the ability of a company to fulfill its financial obligations.

Looking forward to the June quarter, the company expects its revenues to grow from 5% to 7% year-over-year while earnings are likely between $2.20 and $2.50 per share. In FY24, DAL has projected earnings to range from $6 to $7 per share, and free cash flow is forecasted to be between $3 billion and $4 billion.

What is the Future of DAL Stock?

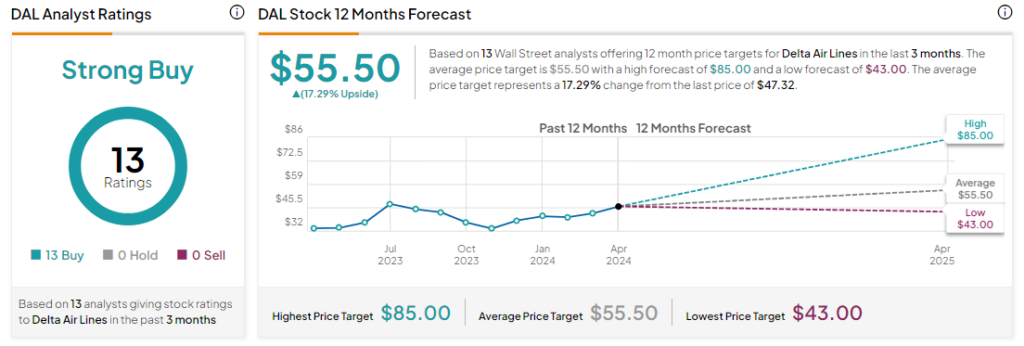

Analysts are bullish about DAL stock, with a Strong Buy consensus rating based on a unanimous 13 Buys. Year-to-date, DAL has soared by more than 15%, and the average DAL price target of $55.50 implies an upside potential of 17.3% from current levels. However, these analyst ratings are likely to change following DAL’s Q1 results today.