Cybersecurity firm Zscaler (ZS) is set to release its fiscal Q4 2024 financials on September 3. Wall Street analysts expect the company to report earnings of $0.70 per share for Q4 2024, up 9% year-over-year. At the same time, analysts expect revenues of $567.47 million, higher than the year-ago figure of $455 million, according to TipRanks’ data.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It’s important to highlight that the company has surpassed the consensus EPS estimates in all of the last nine quarters.

Key Takeaways from TipRanks’ Bulls & Bears Tool

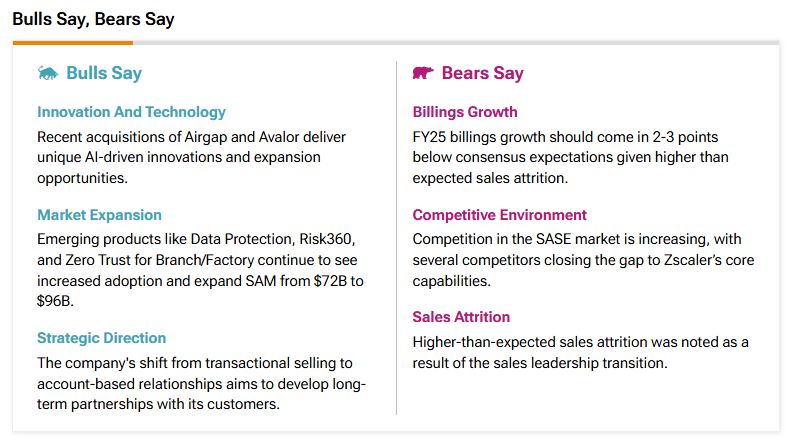

According to TipRanks’ Bulls Say, Bears Say tool shown below, bulls are optimistic about Zscaler’s future, citing the recent acquisitions of Airgap and Avalor as key drivers of AI-driven innovations and expansion. They also highlight the growing adoption of products like Data Protection, Risk360, and Zero Trust for Branch/Factory, which have expanded the Serviceable Available Market (SAM) from $72B to $96B.

It’s also important to consider the bearish arguments. The bears are worried about customer losses over time. They argue that FY25 billings growth may fall short of expectations due to higher-than-expected sales attrition. Additionally, they point out that competition in the SASE (Secure Access Service Edge) market is intensifying, with competitors closing in on Zscaler’s key strengths.

What Do Options Traders Anticipate?

Using TipRanks’ Options tool, we can see that options traders are expecting a 13.03% move in either direction right after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement.

Is ZS Stock a Good Buy?

Turning to Wall Street, analysts have a Strong Buy consensus rating on ZS stock based on 25 Buys, six Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 12% year-to-date decline, the average ZS price target of $232.04 per share implies 19.63% upside potential.