Most of the time, when analysts come out in favor of a stock, it gets a little extra push as investors recognize its value. For cybersecurity stock Zscaler (NASDAQ:ZS), that’s definitely the case, as a little extra appreciation from analysts shot it up over 4% in Monday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The word came out of Barclays, where analysts led by Saket Kalia bumped Zscaler from Equal Weight up to Overweight and also hiked the price target from $176 to $190. One of the biggest draws for Barclays analysts was the rise of secure access service edge, or SASE. SASE could ultimately prove a match for network security itself in terms of opportunity, and Zscaler is very much a leader in this sector. Since SASE already represents a market of between $5 billion and $9 billion and is expected to grow another 20% to 35% through 2026, it’s an opportunity in the making.

What’s more, some analysts have noted that Zscaler stock is “significantly undervalued,” using historical multiples and past performance adjustments as a guide. With remote work still very much a part of the landscape—much to the chagrin of companies demanding back-to-the-office programs—keeping up network security is going to be a big part of the overall tech landscape. While Zscaler is a leader in SASE, it’s also got a lot going on with cloud security, and that’s going to give it an edge too.

Is Zscaler a Buy, Sell, or Hold?

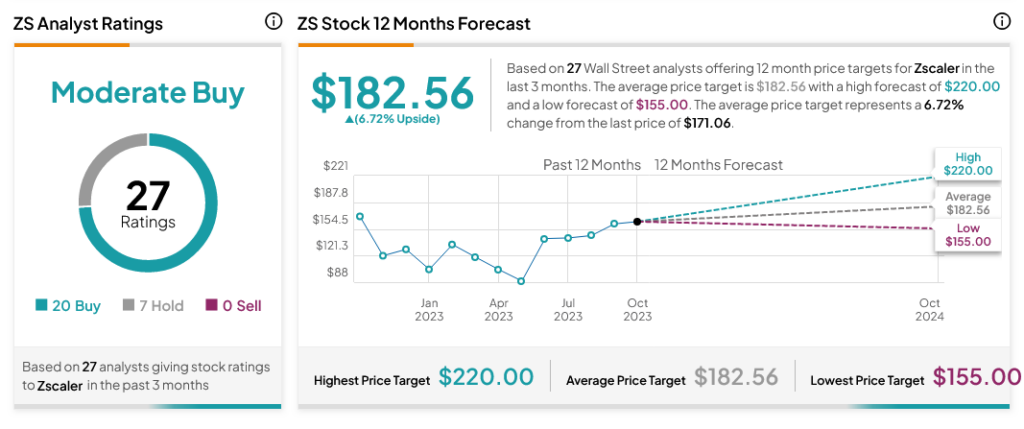

Zscaler enjoys substantial analyst support right now. Currently, Zscaler stock is a Moderate Buy by analyst consensus, with 20 Buy ratings and seven Holds to support the hypothesis. Meanwhile, Zscaler stock offers investors a 6.72% upside potential thanks to its average price target of $182.56.