It started out as a pretty bad day for cybersecurity stock Zscaler (NASDAQ:ZS). It was down nearly 5% in premarket trading. However, as the morning gave way to the afternoon, Zscaler’s fortunes reversed, trending all the way back into green territory, albeit fractionally.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The news should not have been this bad for Zscaler. It turned in its first-quarter earnings results and managed to beat analyst expectations. The problem—such as it was—was a disappointment with its billings forecast, which wasn’t quite up to the levels expected. Yet, despite that, most analysts were okay with the growing momentum of new deals Zscaler set up in that time.

Meanwhile, Wedbush Securities’ Dan Ives came out with some of the best praise for Zscaler that day, noting that the combination of rapid expansion and contained costs were all the proof anyone should need of its overall success. Even Zscaler’s projections should have been encouraging; while analysts expect Zscaler’s second quarter to come in around $497.3 million, Zscaler itself looks for $505 million to $507 million.

Zscaler’s Unexpected Edge: Resellers

One of the biggest points of gain that Zscaler could offer, according to word from CEO Jay Chaudhry, was Zscaler’s increasing use of VARs, value-added resellers. At first, VARs weren’t particularly interested in handling Zscaler products, Chaudhry noted. But that turned around as it offered more incentives and improved its operations in “zero-trust security” measures. With these points in play, Zscaler has been able to rapidly expand and put out more sales, resulting in the kind of gains already seen—and projected—so far.

Is Zscaler a Buy, Sell, or Hold?

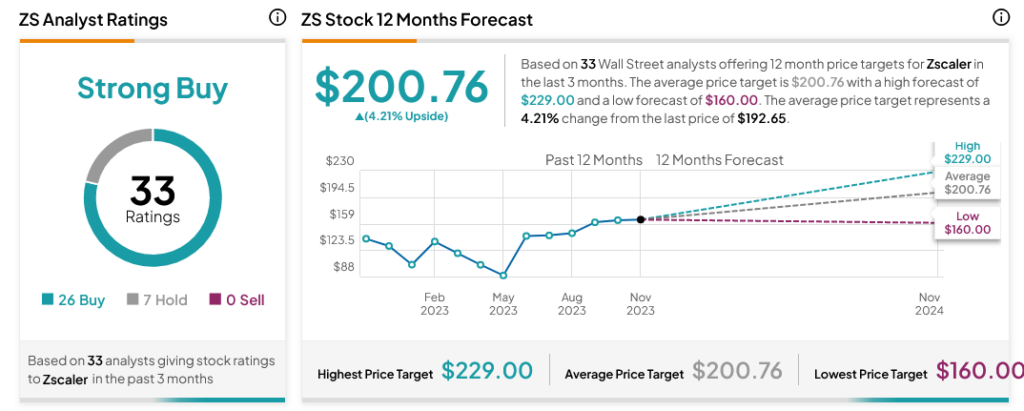

Turning to Wall Street, analysts have a Strong Buy consensus rating on ZS stock based on 26 Buy and seven Holds assigned in the past three months, as indicated by the graphic below. After a 42.68% rally in its share price over the past year, the average ZS price target of $200.76 per share implies 4.21% upside potential.