The stock of Zscaler (ZS) is up 3% after the cybersecurity firm delivered strong Fiscal fourth-quarter financial results and issued upbeat forward guidance.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

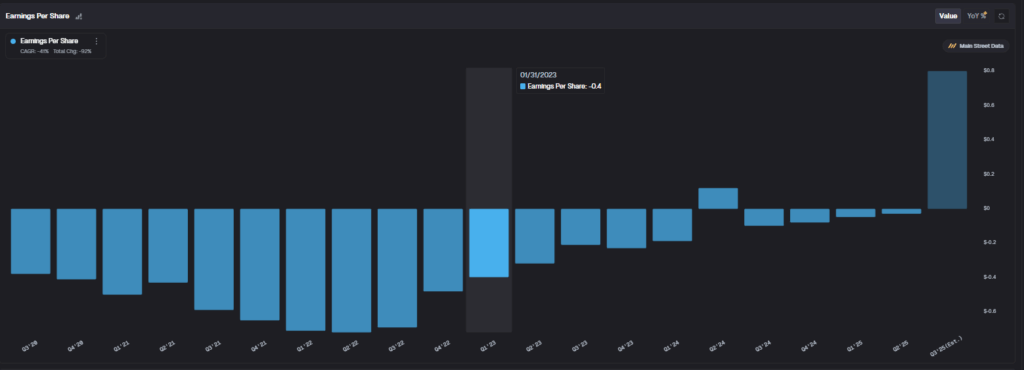

The Silicon Valley-based company announced earnings per share (EPS) of $0.89, which beat the consensus forecast on Wall Street that called for a profit of $0.80. Earnings were up 23% from a year ago. Revenue in Fiscal Q4 totaled $719 million, which surpassed expectations for $707 million. Sales were up 21% year-over-year.

The company added that its billings rose 32% to $1.202 billion in the quarter, which also topped estimates of $1.143 billion. “We achieved a new milestone of more than $3 billion of annual recurring revenue while achieving our highest-ever operating margin for a quarter,” said CEO Jay Chaudhry in Zscaler’s earnings release.

Zscaler’s earnings per share. Source: Main Street Data

Bullish Outlook

In terms of guidance, Zscaler said that for Fiscal 2026, the company expects EPS of $3.66, in line with Wall Street estimates. Management also forecasts revenue in a range of $3.265 billion to $3.284 billion, above analyst estimates of $3.20 billion.

Zscaler provides cloud-based cybersecurity services via 150 data centers worldwide. Zscaler’s web security gateways inspect customers’ data traffic for malware. The company competes against rivals Palo Alto Networks (PANW) and Microsoft (MSFT). Analysts at Morgan Stanley (MS) upgraded ZS stock to a Buy rating heading into this latest print.

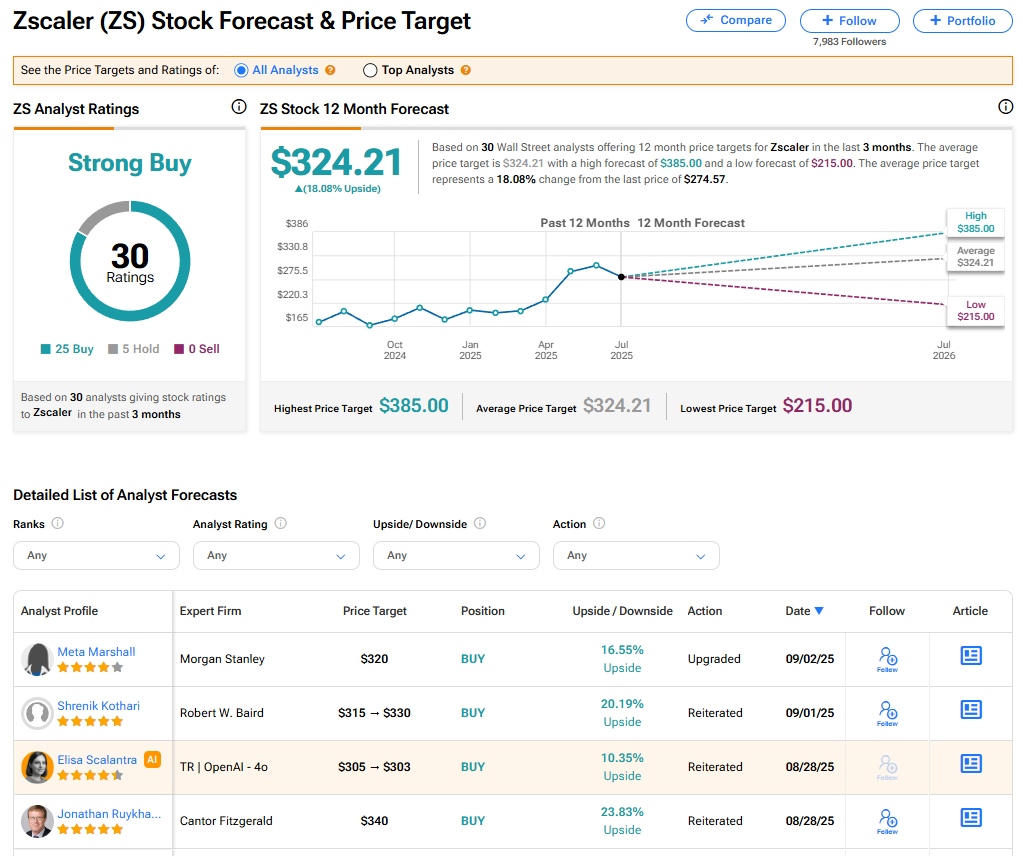

Is ZS Stock a Buy?

The stock of Zscaler has a consensus Strong Buy rating among 30 Wall Street analysts. That rating is based on 25 Buy and five Hold recommendations issued in the last three months. The average ZS price target of $324.21 implies 18.08% upside from current levels. These ratings are likely to change after the company’s financial results.