Kash Rangan, a five-star analyst from Goldman Sachs, reiterated a Hold rating on Zoom Video Communications (NASDAQ:ZM) stock despite the company exceeding Q1 FY25 estimates. Moreover, the analyst cut the price target on ZM stock to $70 (9.6% upside) from $73, citing caution on weak demand trends and guidance.

ZM operates an artificial intelligence (AI)-powered open collaboration platform that aims to streamline communications and increase employee engagement through services such as video conferencing, messaging, voice calls, and virtual events.

Zoom’s Q1 revenue rose 3.2% year-over-year to $1.14 billion and adjusted earnings per share (EPS) of $1.35 was stronger than the prior-year quarter’s figure of $1.16. The company maintained its Q2 outlook but slightly raised its full-year Fiscal 2025 guidance. Zoom’s Q2 earnings guidance fell short of analysts’ expectations and weighed on the stock. In the past year, ZM shares have lost 10.6% of their value.

Rangan’s Views on Zoom Video’s Future Potential

Rangan believes that Zoom Video could face macro headwinds in the next couple of quarters but the long-term potential remains bright. The analyst notes that the company is on its way to becoming a full-fledged UCaaS (Unified Communications as a Service) platform with a focus on new solutions, including Phone, Rooms, and Contact Center. Plus, Rangan is optimistic about Zoom’s increasing wallet share, backed by its vast Enterprise footprint.

As of Q1 end, ZM had roughly 191,000 Enterprise customers and a trailing 12-month net dollar expansion rate for Enterprise customers of 99% (lower than Q4’s rate of 101%). In the long run, Rangan believes that Zoom will be able to build a sticky platform encompassing Meetings, Rooms, Phone, Chat, and other offerings, all strengthened by generative AI.

Rangan noted the catalysts for Zoom Video’s potential success and believes that the company is well-positioned to be “one of the most strategic application software companies” in the $100 billion communications and collaboration TAM (total addressable market). The potential catalysts include a lower-than-expected churn rate, accelerated platform momentum, increased channel contribution, and a favorable operating environment.

Rangan is a Top Analyst on TipRanks

Kash Rangan ranks 403 among more than 8,800 analysts on TipRanks. With a success rate of 60%, Rangan has achieved an average return per rating of 10.50%.

What is the Price Target for ZM Stock?

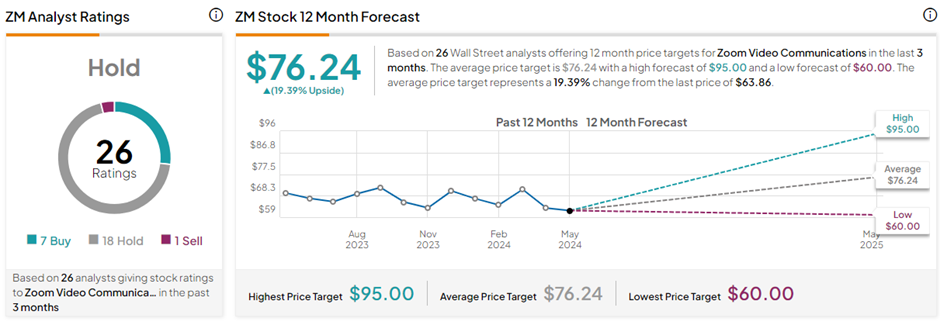

Many analysts share Rangan’s sentiment for ZM stock about near-term pressures. On TipRanks, the stock has a Hold consensus rating based on seven Buys, 18 Holds, and one Sell rating. The average Zoom Video Communications price target of $76.24 implies 19.4% upside potential from current levels.

Ending Thoughts

Based on Rangan’s thesis, Zoom Video Communications is poised for robust growth in the long term, supported by the company’s efforts to integrate AI into its services and enhance its product offerings. Nonetheless, the analyst remains sidelined on the stock due to macro challenges.

Despite the Hold consensus rating, the average price target reflects a reasonable share price appreciation potential in ZM stock in the next twelve months.