Shares of Zoom Video Communications (NASDAQ: ZM) are down in after-hours trading after reporting earnings for its third quarter of Fiscal Year 2023. Adjusted earnings per share came in at $1.07, which beat analysts’ consensus estimate of $0.83 per share.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Sales increased 4.8% year-over-year, with revenue hitting $1.1 billion. This was in line with the $1.1 billion that analysts were looking for.

Looking forward, management now expects revenue and adjusted earnings per share for Q4 2023 to be in the ranges of $1.095 billion to $1.105 billion and $0.75 to $0.78, respectively. For reference, analysts were expecting $1.12 billion in revenue along with an adjusted EPS of $0.82.

Is ZM Stock a Buy or Sell?

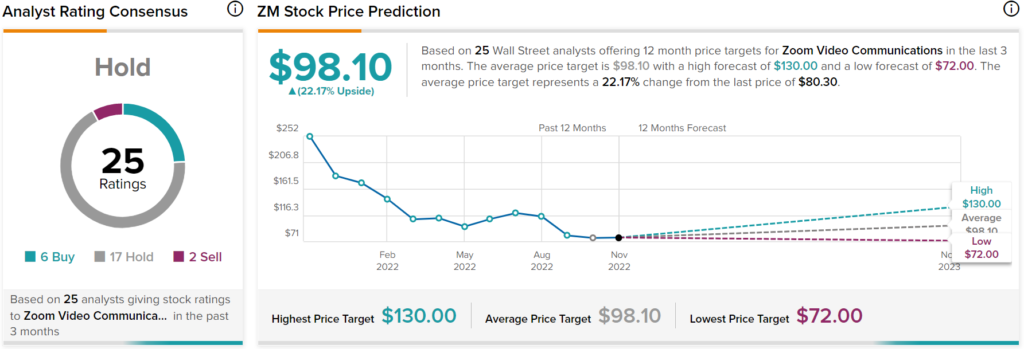

ZM has a Hold consensus rating based on six Buys, 17 Holds, and two Sells assigned in the past three months. The average ZM stock price target of $98.10 implies 22.17% upside potential.