Shares of cloud-based communication platform Zoom Video Communications (NASDAQ:ZM) gained in after-hours trading after the company reported earnings for its third quarter of Fiscal Year 2024. Earnings per share came in at $1.29, which beat analysts’ consensus estimate of $1.08 per share.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Sales increased by 3.6% year-over-year, with revenue hitting $1.14 billion. This beat analysts’ expectations by $20 million.

According to the company, the main drivers of its revenue growth were new customers and increased spending from existing customers. As a result, Enterprise customers grew 5% year-over-year to 219,700. Furthermore, Enterprise revenue grew to $660.6 million, up by nearly 7.5% from Q3 2023 levels.

Looking forward, management now expects revenue and adjusted earnings per share for Q4 2024 to be in the ranges of $1.125 billion to $1.13 billion and $1.13 to $1.15, respectively.

Furthermore, the company raised its full-year 2024 revenue forecast and now expects revenue to be between $4.506 billion and $4.511 billion, with a projected EPS of $4.93 to $4.95

What is the Target Price for Zoom?

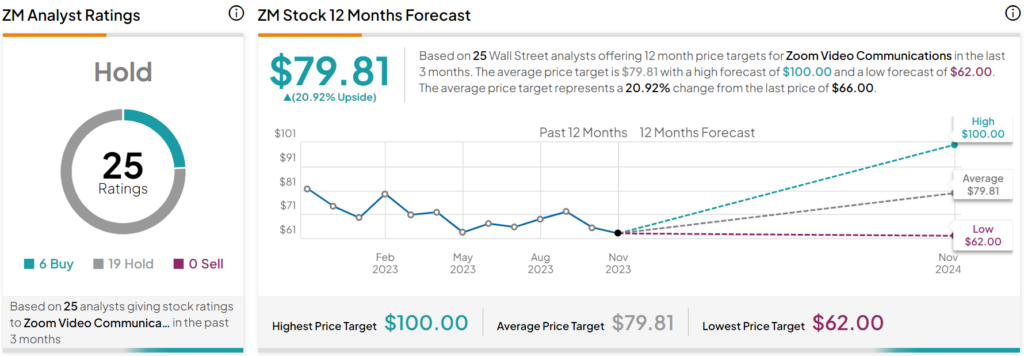

Turning to Wall Street, analysts have a Hold consensus rating on ZM stock based on six Buys, 19 Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 17.8% drop in its share price over the past year, the average ZM price target of $79.81 per share implies 20.92% upside potential.