It was one thing for tech stock Zebra Technologies (NASDAQ:ZBRA) to roll out a winning quarter. But when it was revealed that the next quarter wasn’t likely to deliver such wins, investors took their money and ran. Zebra was down over 10% at the time of writing, all thanks to that dose of cold water that was the post-earnings guidance.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Earnings came in at $3.94 per share, which was a narrow beat over analysts’ projections calling for $3.92. Revenue offered a similarly close call, coming at $1.41 billion, just ahead of the $1.4 billion analysts expected. Worse, though, was that revenue was down 1.4% against the same time the previous year.

Then we got into guidance, and that’s where all hell broke loose. Zebra looks for net sales for the second quarter to be down between 9% and 11% against the preceding year’s sales figures. Conversely, analyst models suggested a sales drop of only 4%. The full year’s sales figures will also be down, but only between 2% and 6%. Still bad news, but perhaps not quite as bad as the next quarter’s projections. One of the biggest causes of trouble for Zebra here came from foreign currency issues, and it’s a trouble that Zebra expects will persist into the full year.

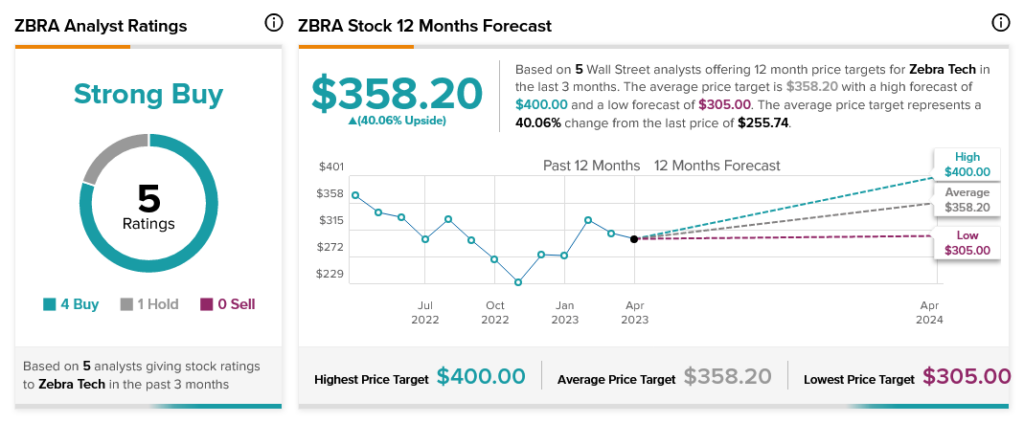

Despite this, analysts are undaunted. With four Buy ratings and one Hold, Zebra Technologies stock is considered a Strong Buy by analyst consensus. Further, with a current average price target of $358.20, Zebra Technologies stock offers its investors 40.06% upside potential.