Last week, we heard about how OpenAI CEO Sam Altman was looking to get a refund on his pre-order for one of electric vehicle giant Tesla’s (TSLA) Roadster models. Altman detailed how the process had been going on for some time, and trying to get a refund out of Tesla was proving difficult at best. But that may not have been the whole story, as Elon Musk himself recently responded. Investors were pretty happy about how it all turned out, with Tesla shares up 3% in Monday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Musk responded to Altman’s story by deflating it in pretty short order. While Altman described a “three-act” story about his saga of pre-ordering and attempting to get a refund, Musk responded with receipts. Musk noted, “And you forgot to mention act 4, where this issue was fixed and you received a refund within 24 hours. But that is in your nature.”

With that issue apparently put to bed, Musk went on to describe the still-upcoming Roadster, declaring that there would be “crazy technology” involved in the vehicle. You may wonder just how crazy that can get, but Musk had a line ready, declaring, “If you took all the James Bond cars and combined them, it’s crazier than that.” Considering that the Lotus Esprit from The Spy Who Loved Me boasted cannons that fired wet cement from the number plate, this may be a note of hyperbole.

But Can It Grow Much More?

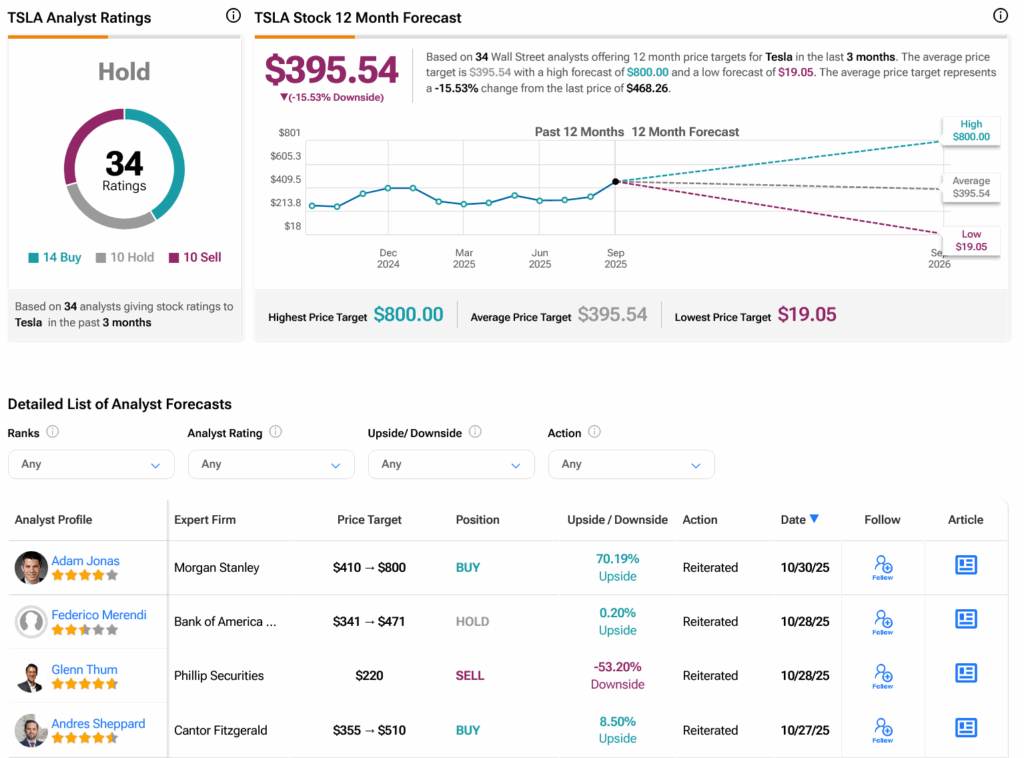

While the exact crazy level of the Tesla Roadster may be debatable, something else up for debate is Tesla itself, and how much farther its stock can go. Bank of America, via analysts Federico Merendi and William Healey, gave Tesla a bit of a boost in the price target, but expressed concerns about where the ceiling actually was. The analysts hiked the target from $341 to $471.

Even as they hiked the price target substantially, they expressed concern about Tesla’s overall valuation, calling it “stretched.” They also noted, “There are challenges in the near term and the current valuation is stretched. Therefore, we reiterate our neutral rating.” With mounting challenges in the auto sector and many of Tesla’s follow-up projects still a ways out—like the Optimus robot—wondering if Tesla can follow up on its gains is not out of line.

Is Tesla a Buy, Hold or Sell?

Turning to Wall Street, analysts have a Hold consensus rating on TSLA stock based on 14 Buys, 10 Holds, and 10 Sells assigned in the past three months, as indicated by the graphic below. After an 88.01% rally in its share price over the past year, the average TSLA price target of $395.54 per share implies 15.53% downside risk.