Social media platform X (formerly Twitter) and its CEO Linda Yaccarino are facing public and corporate backlash over owner Elon Musk’s antisemitic comments. Yaccarino is caught amid the turmoil and is struggling to retain companies from withdrawing advertisements. Meanwhile, Yaccarino’s well-wishers are urging her to quit the role to maintain her reputation in the industry. However, the CEO has full trust in the mission of the platform and X’s employees and is refusing to budge.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This is the second time since June that Yaccarino has been tasked with retaining and winning back advertisers who have been pulling out due to Musk’s shenanigans. His lax content moderation policy and the current antisemitic endorsements have triggered advertisers’ criticism. The latest companies to exit/suspend advertising on the platform are iPhone maker Apple (NASDAQ:AAPL) and entertainment giant Walt Disney (NYSE:DIS).

Last week, billionaire Musk endorsed an antisemitic post on X which irked companies. Corporations dislike to see their advertisements appear alongside such hateful content. Companies worry that such endorsements could also lead to customer and employee boycotts. Other companies who have pulled back their advertisements from X during the last week include IBM (NYSE:IBM), Comcast (NASDAQ:CMCSA), and Warner Bros Discovery (NASDAQ:WBD). Musk’s outspoken nature also punishes the shares of his electric vehicle (EV) company Tesla (NASDAQ:TSLA). Some reports suggest that EV owners are mulling ditching their Tesla EVs and shares due to Musk’s support of such conspiracy theories.

Is Tesla a Good Investment?

Today, Bernstein analyst Toni Sacconaghi reaffirmed a Sell rating on TSLA stock with a price target of $150 (36% downside). Although Tesla enjoys a leading demand in the EV space, the analyst believes the market has reached its saturation.

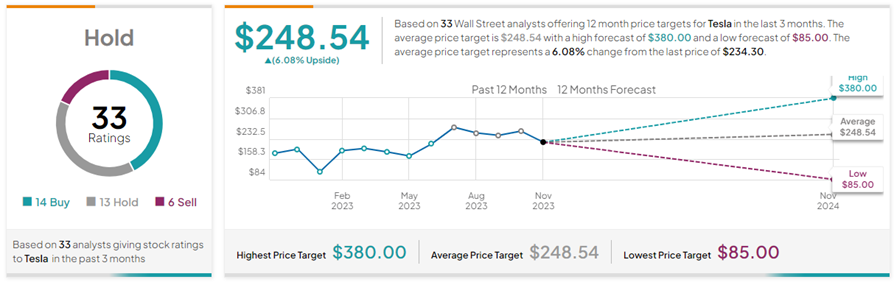

Overall, Tesla has a Hold consensus rating on TipRanks. This is based on 14 Buys, 13 Holds, and six Sell ratings. The average Tesla price target of $248.54 implies 6.1% upside potential from current levels. Year-to-date, TSLA stock has gained 116.7%.