Exchange-traded funds (ETFs) offer a cost-effective solution for portfolio diversification, thanks to their low expense ratios compared to individual stocks. Furthermore, these ETFs are simple to trade, and budget-conscious investors may find them attractive due to their low minimum investment requirements. By leveraging the TipRanks ETF Screener to scan for ETFs with more than 40% upside potential in the next 12 months, we have shortlisted two such funds: XTL and BTEC.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Let’s take a deeper look at these two ETFs.

SPDR S&P Telecom ETF (XTL)

The SPDR S&P Telecom ETF seeks to track the investment results of the S&P Telecom Select Industry Index. XTL has $60.52 million in assets under management (AUM), with the top 10 holdings contributing 40.12% of the portfolio. Further, the expense ratio of 0.35% is encouraging.

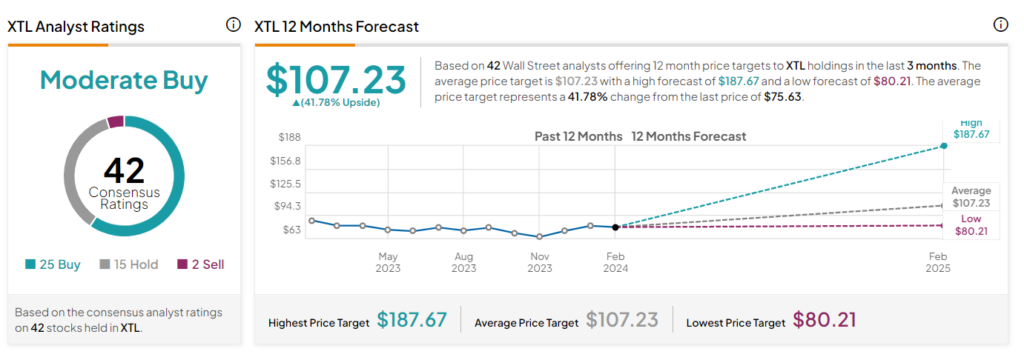

On TipRanks, XTL has a Moderate Buy consensus rating. This is based on the consensus rating of each stock held in the portfolio. Of the 42 stocks held, 25 have Buys, 15 have a Hold, and two stocks have a Sell rating. The average XTL ETF price forecast of $107.23 implies a 41.8% upside potential from the current levels. The XTL ETF has gained 9% in the past three months.

Principal Healthcare Innovators ETF (BTEC)

The Principal Healthcare Innovators ETF invests in early-stage companies within the healthcare industry that are not yet consistently profitable. The ETF seeks long-term capital appreciation. BTEC has $50.14 million in AUM, with its top 10 holdings contributing 22.13% of the portfolio. Its expense ratio stands at 0.42%.

On TipRanks, BTEC has a Moderate Buy consensus rating. Of the 219 stocks held, 182 have Buys, 31 have a Hold rating, and six have a Sell rating. The average BTEC ETF price target of $56.78 implies a 50.6% upside potential from the current levels. The ETF has gained 31.5% in the past three months.

Ending Note

Higher liquidity, low cost, and portfolio diversification are some of the factors that make ETF investments worth considering. Investors looking for ETF recommendations could consider XTL and BTEC due to the solid upside potential expected by the analysts.