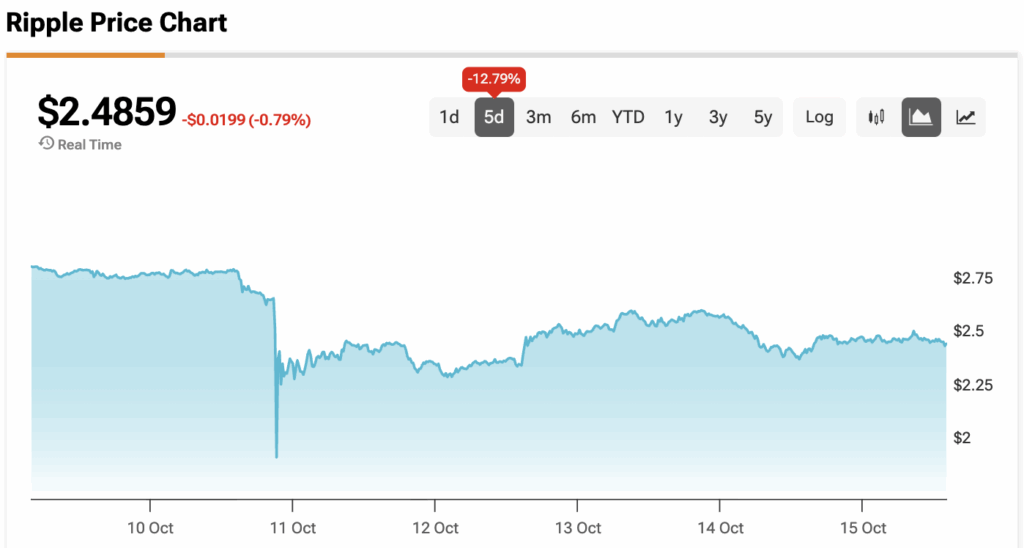

Ripple’s XRP (XRP-USD) has been dancing on a fault line since its brutal 45% intraday collapse on October 10, when prices plunged from $2.83 to $1.53 within hours. The fall was triggered by President Trump’s threat of 100% tariffs on China, which sent shockwaves through equities, commodities, and crypto markets alike.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The token has clawed its way back to $2.52 after recovering from that chaotic day’s lows, but the path forward remains uncertain. For XRP traders, the question now isn’t only how high it can climb but whether the ground beneath it is still stable.

Delayed Catalysts Test Investor Patience

October was supposed to be the breakout month for XRP. Traders had been counting on potential ETF approvals to inject momentum into the market. Instead, the ongoing U.S. government shutdown has frozen SEC decision-making, leaving those hopes hanging in the balance.

Moreover, the delay has cooled sentiment at a time when investors were just beginning to turn optimistic again. The sudden stall has shown how quickly enthusiasm can fade when anticipated regulatory catalysts fail to arrive on schedule.

Rising Risks Threaten the Next Leg Down

The most immediate danger comes from what happens if those catalysts never materialize. A regulatory rejection of the proposed XRP ETF would shut the door to a major source of institutional capital and deal a blow to Ripple’s goal of bridging traditional finance with crypto.

Still, the risks go well beyond the SEC. The trade war between Washington and Beijing continues to simmer, and any new escalation could once again spook investors out of risk assets. XRP’s October crash revealed just how vulnerable the token is to macro shocks and leveraged liquidations.

Leverage and Liquidity Hold the Market’s Fate

When XRP crashed earlier this month, roughly $19 billion in leveraged crypto positions were wiped out in hours. That sudden unwinding left deep scars across the market. If another liquidity event hits, the same feedback loop of margin calls and forced sales could easily resurface.

Moreover, as XRP’s price hovers just above key technical levels, a break below $2 could invite algorithmic selling. A cascade of automated exits could then drag the price toward the psychological $1 threshold faster than most expect.

The Macro Picture Could Make or Break It

Even if traders dodge those short-term risks, the broader economy remains a major variable. A slowdown in growth or a renewed credit squeeze could send investors running from volatile assets once again. In that kind of market, tokens like XRP would likely suffer more than larger names such as Bitcoin or Ethereum.

That said, if macro conditions hold steady, XRP still has the potential to rebound sharply once ETF clarity arrives. The same leverage that magnifies losses could also amplify gains in a more favorable environment.

Remember, Caution Is Not Cowardice

XRP has always lived at the intersection of risk and reward, but October’s crash was a reminder that its volatility cuts both ways. While ETF approvals, regulatory clarity, and deeper financial integration could all lift prices toward $3 again, the downside remains just as steep.

Moreover, the October 10 collapse proved that a 45% loss can happen in a single trading session. Investors should see that not as a warning to stay away, but as a reason to respect the market’s power.

At the time of writing, XRP is sitting at $2.4859.